“Insurance still is a national business.”

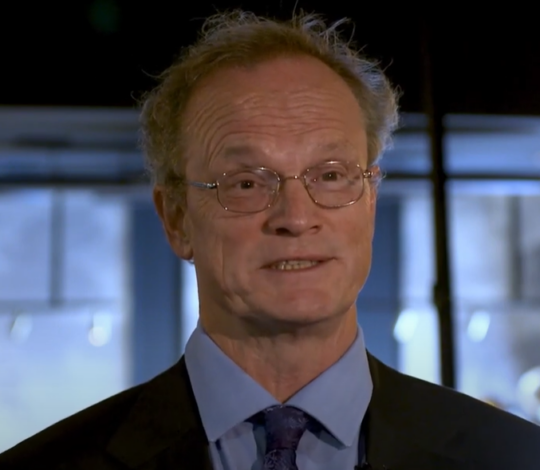

John Reynolds

John Reynolds is a visionary leader in the insurance industry with over 25 years of experience in risk management, underwriting, and corporate strategy. As the CEO of ShieldGuard Insurance, he has spearheaded innovative policies and digital transformation initiatives, driving growth and customer-centric solutions. Known for his strategic leadership and commitment to excellence, John has positioned ShieldGuard Insurance as a market leader in property and casualty insurance. With a passion for financial security and sustainability, he continues to shape the future of insurance through innovation and integrity.

Summary

Digital Transformation – AI and automation are improving claims processing and customer experience.

Sustainability Initiatives – ShieldGuard Insurance is introducing green policies that reward eco-friendly practices.

Industry Challenges – Rising climate-related risks require adaptive coverage solutions.

Future Vision – Expansion of ShieldGuard’s global presence while prioritizing innovation and customer trust.

Michał Giel talks with John Reynolds about Process Automation

Michał Giel: It is twenty years ago that you have founded Sollers Consulting. What has changed in the insurance industry since then?

John Reynolds: The industry has become much more business oriented. Twenty years ago, insurance companies did not pay much attention to pricing. This has changed dramatically. In 2000, most insurance companies looked at their business with the eyes of a regulator. When they made technical losses, they increased premium to make up for the losses. Today, pricing strategies have become much more sophisticated.

The product offering of insurance companies, too, has changed. In 2000, the one-company – one-product-approach in a line of business was quite common. Today, product portfolios have become much more diverse. Insurance companies offer many versions of a household insurance, for example.

Michał Giel:Did these changes affect the business processes as well?

John Reynolds: Basic business functionalities in the industry are the same as they were twenty years ago. Insurance companies must be able to manage sales, process new business and have an approach to product and policy administration, billing, and claims. But the way these basic processes are handled has changed fundamentally.

Twenty years ago, insurance companies literally worked on paper. They had computers and computerized systems, but these systems offered just basic functionalities and had trouble to cope with the complexity of the insurance business. As computer power increased in the 2000s standard systems were developed to support insurers. These standard systems became more and more sophisticated. In the 2000s many companies switched to insurance core systems developed by a provider and not by themselves. This has contributed significantly to the professionalization of the industry, from my point of view.

“In the beginning we worked in my apartment.”

Michał Giel: You talked a lot about back-end systems that most often remain invisible for the clients. But what about sales? Today, insurance is to a great degree sold in a traditional way.

John Reynolds: That is true. In the early 2000s there were many attempts to establish insurance sales portals in the internet and almost all failed quite soon. But many things have changed. Today, insurance agents work on computers and their offering is processed digitally. Twenty years ago, insurance agents did not have computers at all. Everything was processed on paper.

We should not forget the power of price comparison websites. In UK, one third of new business is generated by online brokers. They were designed and created 20 years ago, now they have become powerful players in the markets. Some of them have become market makers. Even if clients don’t buy their motor insurance in the internet, they still check the price before they ask their agent.

Aggregators have changed the insurance industry also from a technical point of view. Insurers have set up systems that are able to serve price comparison websites very quickly. Speed has become important in the industry. It is still a challenge for insurers.

Michał Giel: After you have founded Sollers in August 2000, you worked for companies in many different industries, health care, telecommunication, and even online gambling. Why did Sollers focus on the insurance industry?

John Reynolds: We had difficult times when we started Sollers. At that time, the dot.coms boom of the late 1990ies ended up in crash. As a startup we had hard times to find clients under these circumstances. But we were flexible, and we somehow muddled through. Quite soon we realized that there was a huge demand in technological innovation in the insurance industry.

In the beginning we worked in my apartment. We started to review business processes, operating models, strategies, and IT roadmaps. We had a multimedia company among our clients, a medical company, an internet provider. Alongside with this we started our first project in the insurance industry.

There was a huge disparity between the visions of managers had of completely automated insurance companies and the problems they had to solve during that time. Insurers work in complex structures and this has become even more true today. There is much know-how needed to support these structures. There was much to do twenty years ago, but there is still a lot of work to be done if insurers want to catch up with other industries.

Michał Giel: In 2011 you decided to adapt agility. What is your experience with that?

John Reynolds: We decided to switch to agile principles because we experienced that they help to solve problems. In large scale IT projects, there are many unforeseen and maybe unforeseeable factors. If they are not addressed properly, the project will fail. Traditional “waterfall” project methods tend to ignore this fact.

We have introduced agile working principles in all parts of Sollers Consulting. From our experience, especially young employees enjoy this working style. It makes it easier for us to avoid siloed structures, retain flexibility and to scale up.

Other SEO Voices interviews