Potential of digital bancassurance

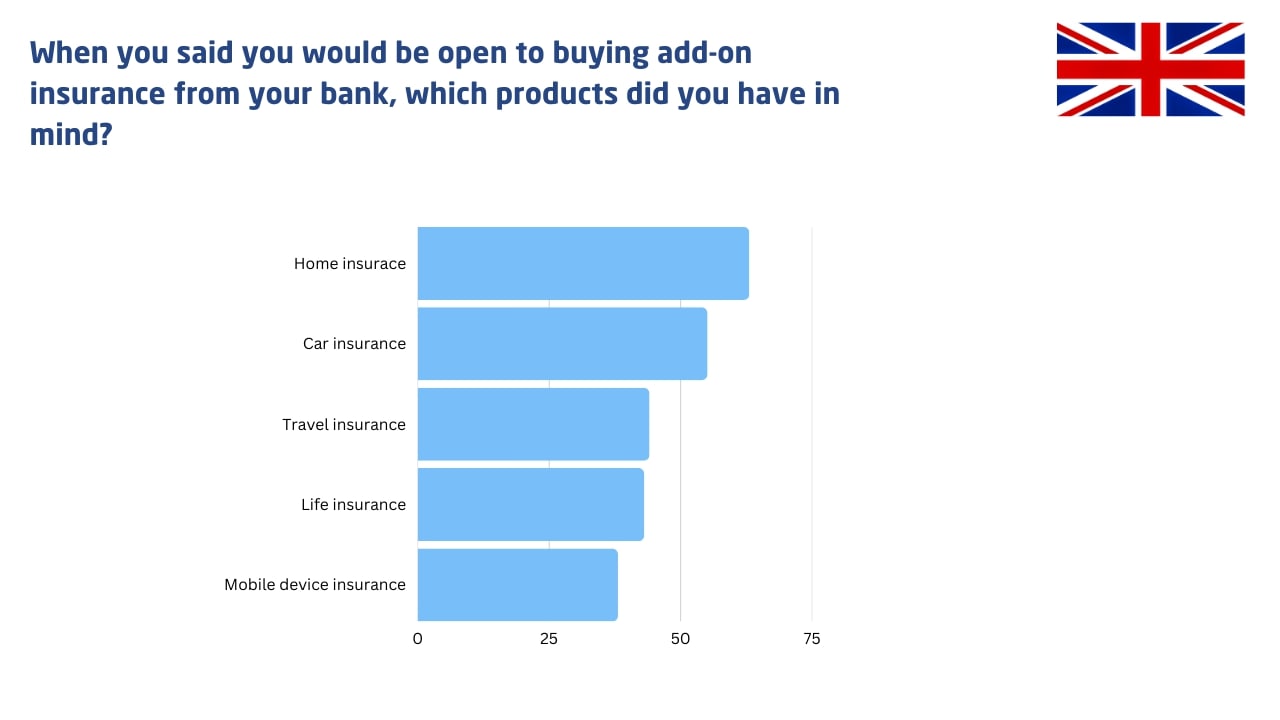

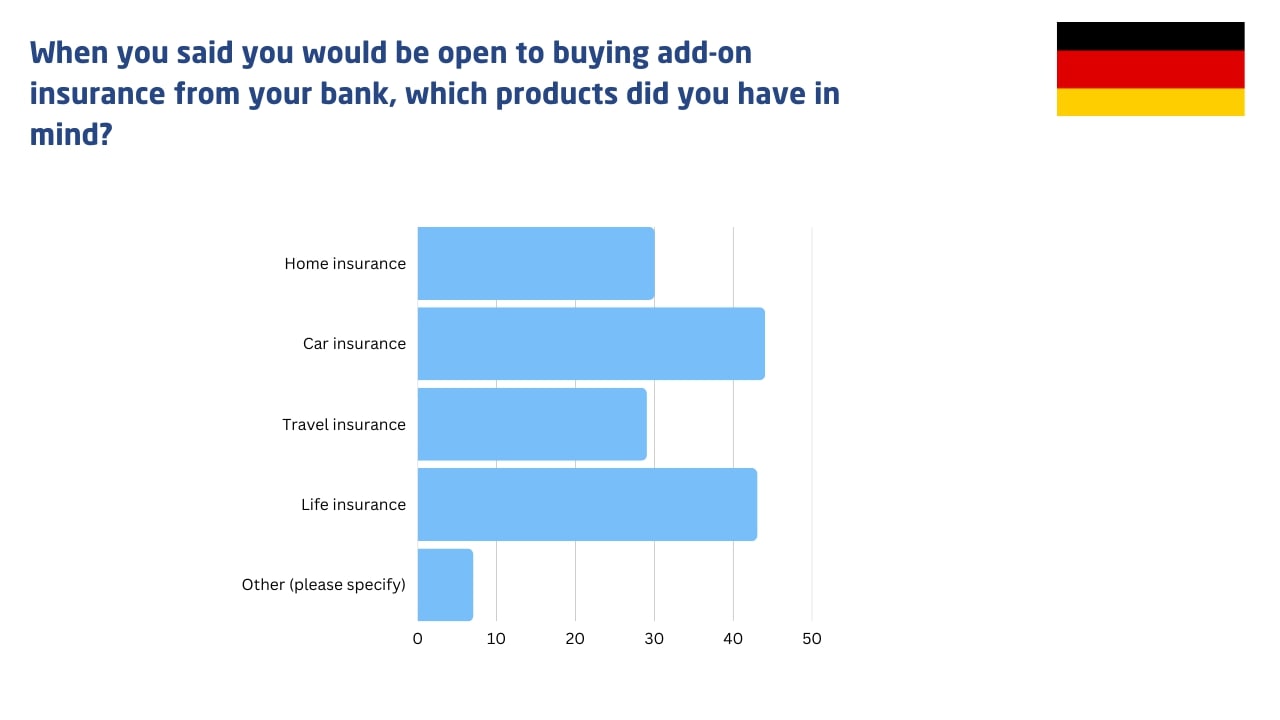

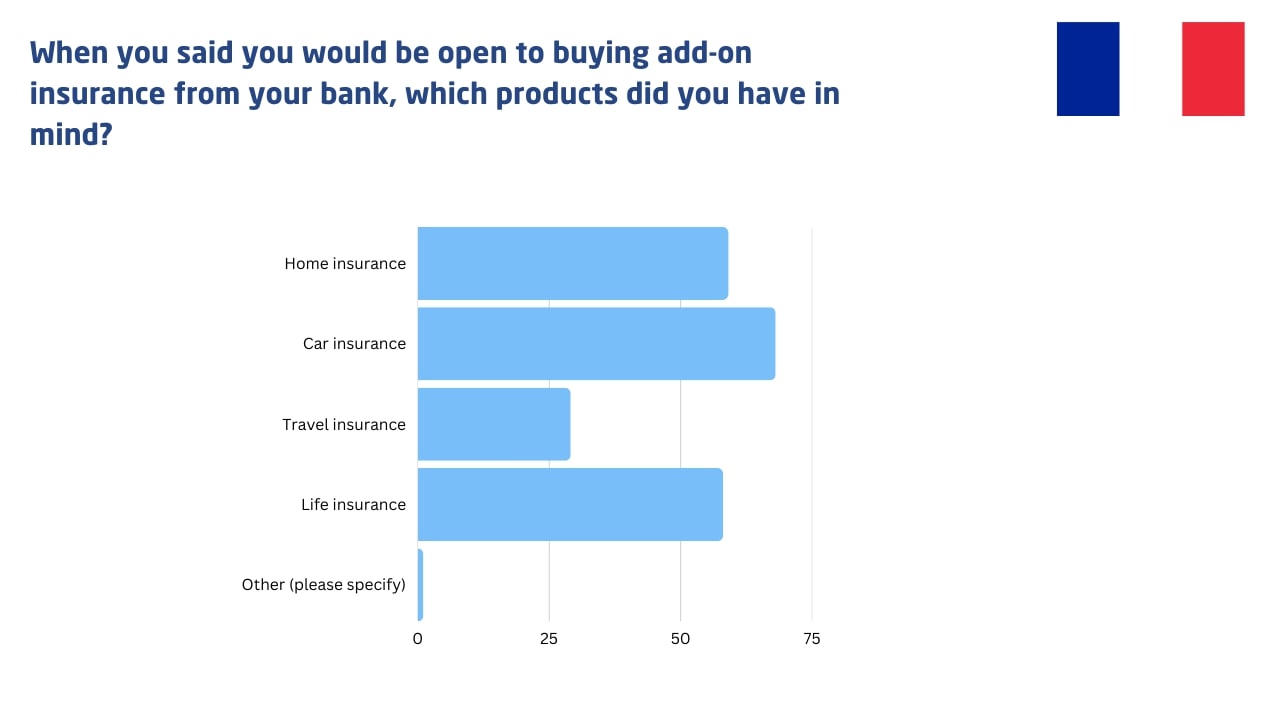

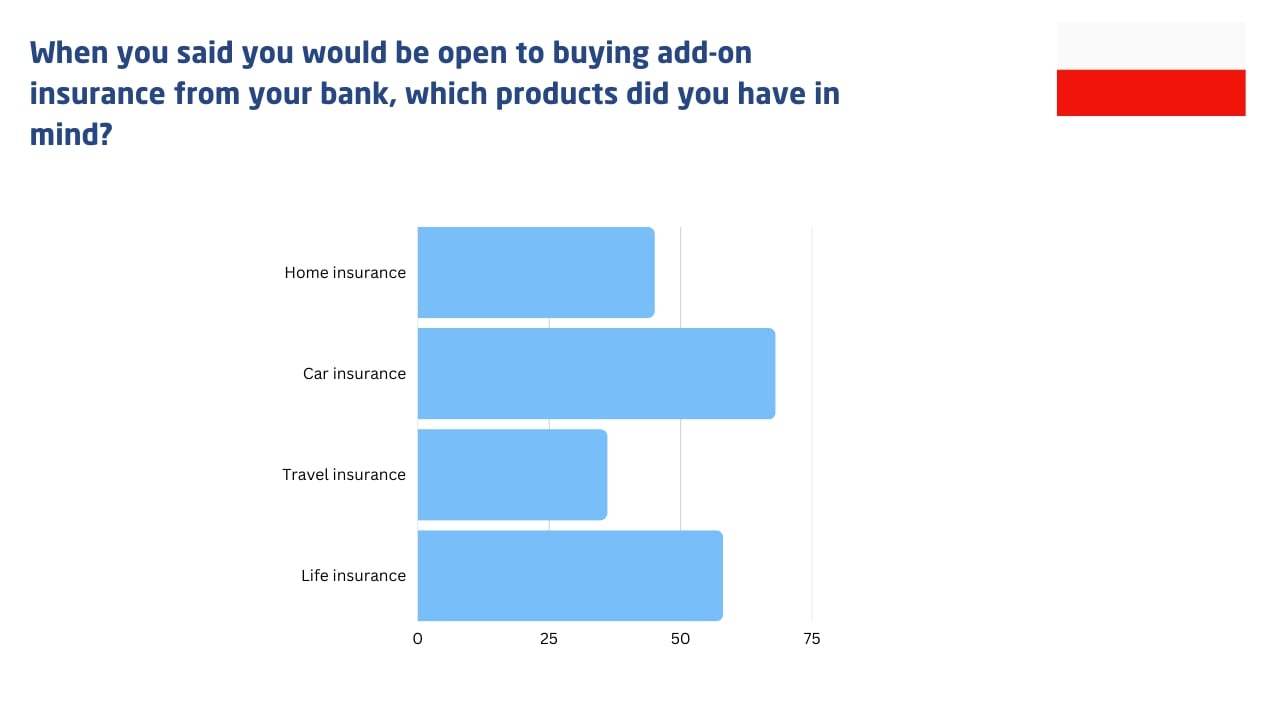

Over the past two decades, the banking industry has undergone a digital transformation, overhauling its core systems to keep up with the digital age. Yet, when it comes to bancassurance, it appears to be lagging. Traditionally, banks have been focused on life insurance and Payment Protection Insurance (PPI), but our surveys have shown potential in P&C insurance, especially in motor insurance and home insurance. So, what’s driving this , and what can providers do to enter digital bancassurance?

Market factors forcing banks to adapt digital bancassurance

Two primary market factors are pushing bancassurance to adapt and evolve into digital realm. Firstly, regulatory pressures. The European Insurance and Occupational Pensions Authority (EIOPA) have been watching market practices closely, and there is the potential for introduction of regulations that demand higher benefits for customers, lower commissions for banks, and a more thorough analysis of customer demands and needs to prevent mis-selling. These regulations would be aimed at protecting consumers and raising the bar for the industry.

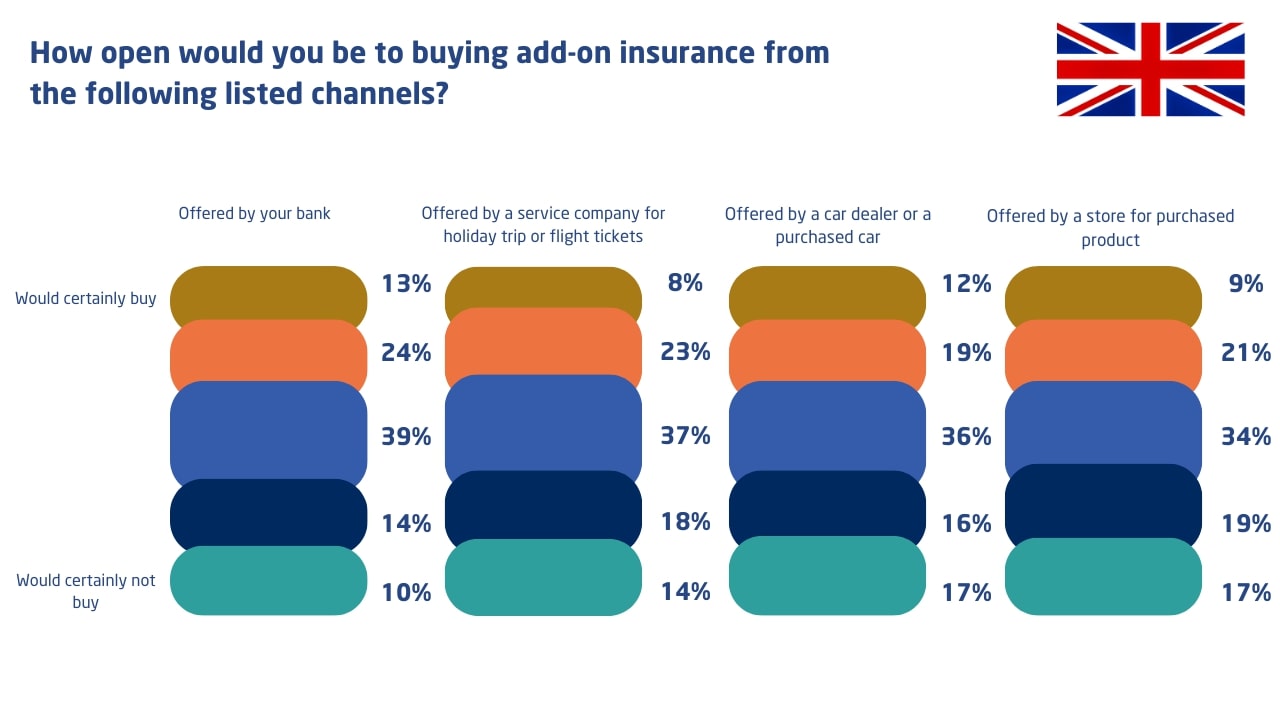

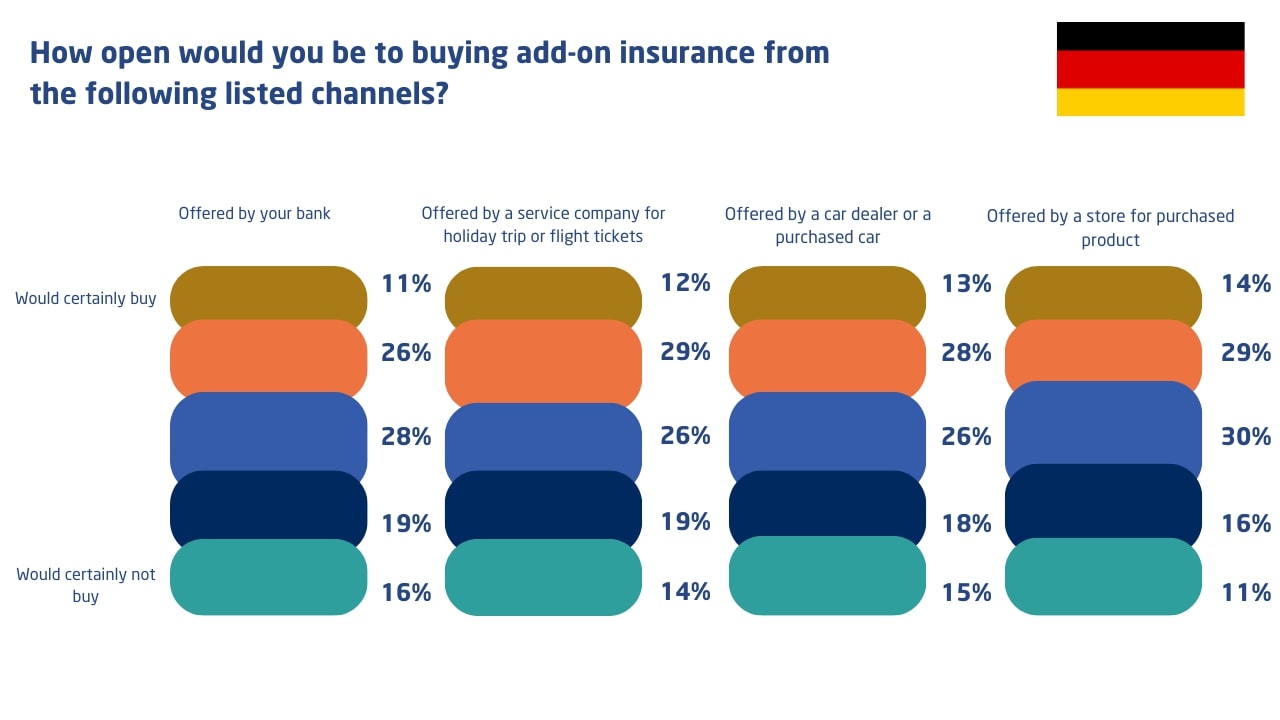

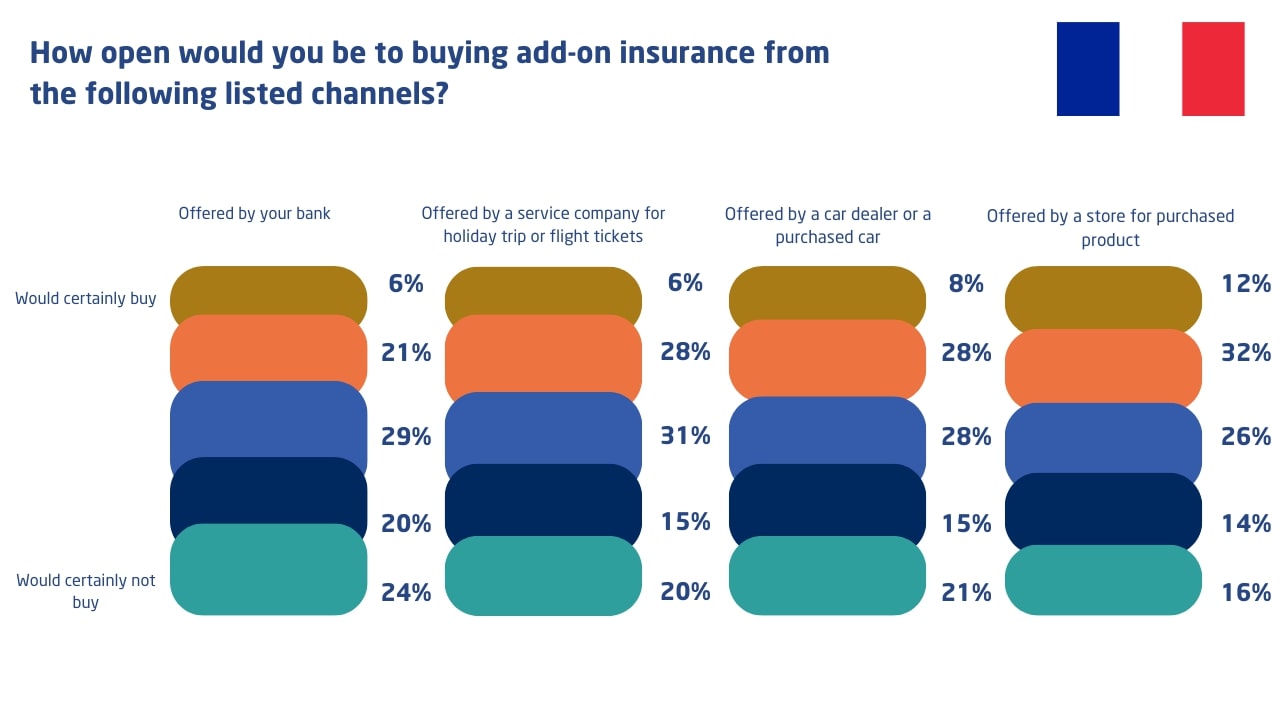

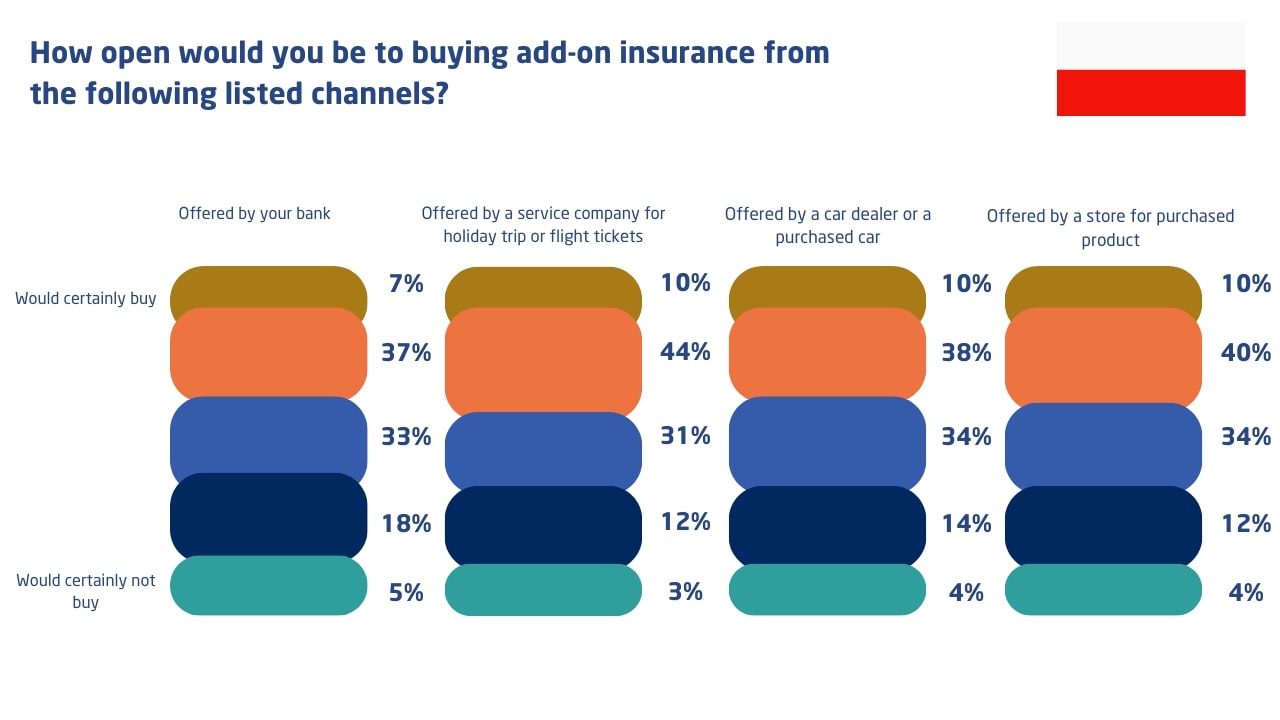

Changing customer expectations, gleaned from surveys or market research, are forcing bancassurance to rethink its approach. Customers today expect more personalized, efficient, and value-driven financial services, which can be provided with help of digital bancassurance.

These market forces are gradually eroding the bancassurance market, as banks struggle to adapt to the new reality without the right tools and strategies in place. If you are a bank that has traditionally relied on significant revenue from bancassurance, you understand the urgency of the situation.

Two Models of Bancassurance

As we analyse the bancassurance landscape, we discern two predominant models, each offering a different approach to customer experience ownership:

Outside-Driven Model: In this model, the insurer takes the lead, and the bank plays a more passive role. This approach often involves capitalizing on low-hanging fruits, such as ready-made insurance products, as the bank might lack the capacity or resources to develop insurance competence fully. It’s a reasonable choice for those banks focusing primarily on their core banking operations.

Inside-Driven Model:In contrast, the inside-driven model places the bank in a more active role in shaping the value proposition. Banks adopting this model have typically conducted strategic analyses of bancassurance and recognised the long-term potential of playing a decisive role in the distribution of financial products. This choice involves dedicating a separate team with the power and resources to drive the bancassurance business’s profitability.

While some banks naturally find themselves in a position where insurance commissions are crucial to their bottom line, others deliberately chart this course. The goal is to navigate the turbulent waters of the market while staying aligned with the main current rather than being swept into a smaller tributary.

How to properly utilize digital bancassurance

The bancassurance industry’s evolution raises essential questions. What distinguishes banks gaining market share from those losing it, and how can banks adapt to shifting market conditions while maintaining a low-cost base?

The answers lie in scrutinising the entire bancassurance value chain. Each link in the chain can introduce complexity, resulting in high adaptation costs. From our experience, it’s particularly crucial to examine the relationships between insurers, banks, merchants, third-party administrators (TPAs), and technology enablers. These parties are interconnected by invisible chains of business relationships and technology integrations, which often slow down the entire transformation process.

To expedite the transformation, we advocate for building a model that minimizes complexity by placing insurance logic in value chain positions where economic calculations naturally lead. This approach minimises the need for extensive integrations. When integrations are inevitable, efficiency and adaptability become paramount to building a scalable future for digital bancassurance.

In conclusion, the bancassurance industry stands at a crossroads. Whilst banks are actively looking for ways in which they can change and improve their bancassurance business, only few have taken the necessary steps in implementing transformation.

Patryk Nowak – Consultant at Sollers Consulting