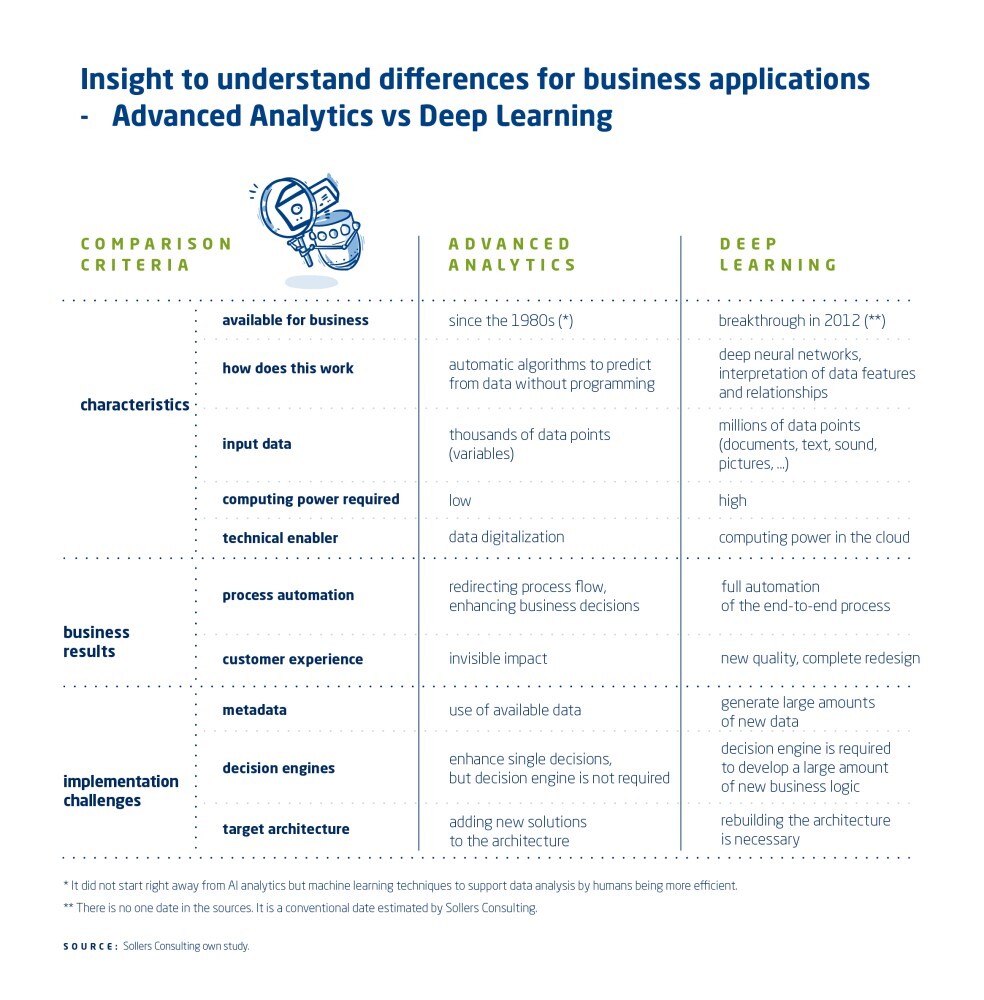

From advanced analytics to deep learning

Advanced analytics based on machine learning has been known for many years, but the necessary structured data was hidden in documents and photos – it’s like having an engine without fuel. In the last decade, thanks to the power of cloud computing, various AI tools based on deep learning have been developed. They will allow insurers to overcome the obstacle which has also been a blocker to full automation.

Lack of data for advanced analytics

Machine learning analytics have been used in business for years, but it does not seem to significantly change the competitive game in the insurance market. The key reason – most insurance processes are still manual. A human looks at pictures, documents, and communication to make conclusions. However, a human does not need the information in a structured form. And if so, it usually is not like this. In current manual business processes, there is not much data for analytics – a picture of a document is useless. The second reason – AI analytics have only a limited impact on a business process, enhancing it but not allowing for its significant redefinition.

Example Insurance applications of advanced analytics

- fraud detection

- damage prevention

- optimization and control of claims handling

- customer retention management

- advanced insurance quotes

- cross-selling optimization

- optimization of sales decisions

Deep learning will change the game

Neural networks, which are the key for advanced AI tools, have been known since the fifties, but only access to high computing power in the cloud has enabled it for business applications since around 2012. However, the business needs time to learn and adapt to it. It is a relatively slow process, but it has begun.

Inspecting and appraising cars is an example of a business process that needs specialized AI solutions based on deep learning for automation. I have already counted over a dozen dedicated start-ups, and the first one, Tractable, was founded in 2014.

Example insurance applications of Deep Learning

- automate processing documents in motor claims

- automate the handling of accident insurance claims from medical documents

- automate processing underwriting applications and propose insurance offers

- automate health insurance claims

- automate the handling of assistance claims

- automate setting up claims from customer emails

Platforms with ready-to-use AI tools

However, many other manual insurance business processes with documents, emails, and pictures require only standard AI tools. Examples include underwriting and claims handling. Companies like Google & Microsoft provide cloud platforms with many dedicated ready-to-train and use AI tools, which democratise the usage of AI – you do not need to be a scientist to configure them.

New business opportunities

AI tools powered by deep learning will enable many new possibilities, such as:

- Complete automation – An AI tool will do the job instead of an underwriter or claim handler resulting in lower operational costs.

- Reducing leakage – Reducing claim handler mistakes thanks to AI tool consistency.

- Redefine customer experience – Service or actively support a customer in seconds, compared to days in the human-operated process.

- New data for analytics – Information hidden in documents and in an employee’s brain will become available for data analytics (e.g. fraud detection), which was not available before.

AI Implementation challenges

If you don’t want to design and develop your own tools, training with off-the-shelf AI tools is the easy part.

The common challenge for implementing predictive analytics is that there is not much structured data in your systems. The challenge to automate business processes with automatic document recognition is different. Once AI reads information from a document, you need to store it as data in your systems. Using the information for process automation makes the number of business rules explode, which creates the need for a business rule engine. The manual, semi-automatic and automatic processes need to co-exist, which means you must modify the user interface to handle the new information and business logic.

Furthermore, think of adding new business processes in many different business lines in the context of security, governance of new skills and knowledge, and sharing some business logic and interfaces. Even for small automation, you will need changes to your current business and IT architecture. Thus, you must rethink the target architecture and develop common assumptions before starting implementation. Otherwise, the implementation might end in chaos and inefficiency of sunk costs of temporary solutions. Not to mention – Change Management.

It brings us to the conclusion that you can start small by using advanced analytics to enhance your business processes without the high risk of transformation chaos. However, you would better design the target architecture and plan the transformation if you want to reshape your business processes with AI tools powered by deep learning. Little awareness of the requirements is one of the reasons why the AI transformation might be slow in the market. However, companies that will manage to transform will be in a much better position to compete in the market.

Piotr Kondratowicz

Business Architect at Sollers Consulting