By Davide Santonocito

When a single defect can quietly drain thousands of euros from an insurance core system, the difference between basic QA and mature QA automation suddenly becomes very real.

For many insurers, Quality Assurance (QA) is still viewed as an unavoidable cost rather than a strategic tool. However an analysis for a major Japanese insurer shows that the way QA automation is set up in insurance can mean the difference between predictable expenditure and costly crisis management.

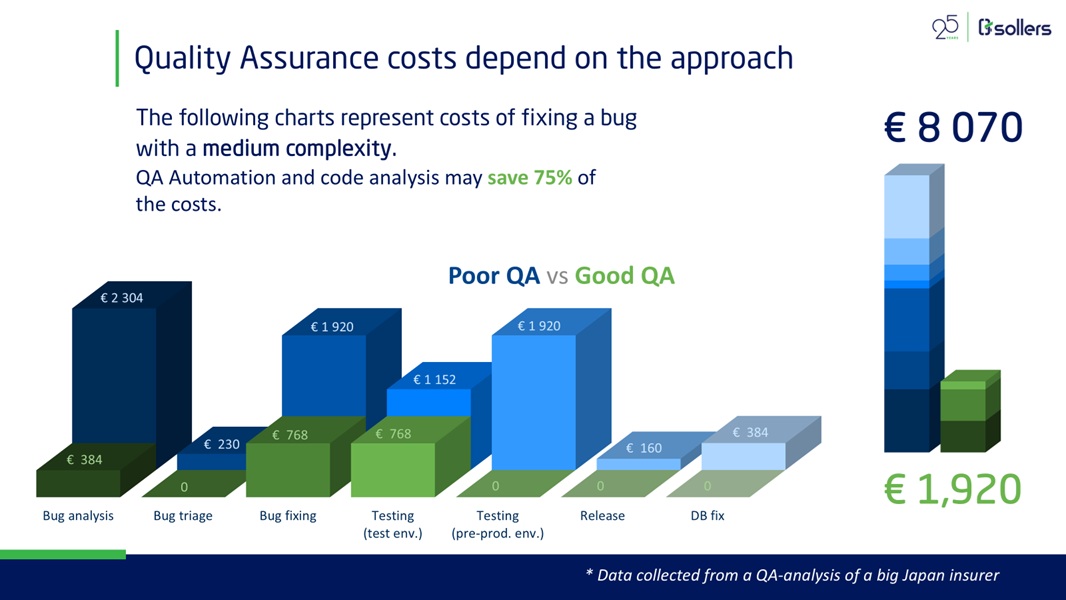

To illustrate this, we compared two scenarios for fixing a medium-complexity bug that impacted 3% of the customers using a core insurance system: one with poor QA, and one with good QA supported by test automation and code analysis. This analysis was conducted post mortem by the insurer, which then re-estimated the total costs using GoQu. The key difference was when the bug was detected and how the organisation’s QA process handled it.

When QA is weak, every phase suffers

In the poor QA scenario, the bug slipped through several stages of the lifecycle, directly into production. It was later discovered by customer service, which overnight received over 4 000 phone calls.

Fixing it required:

- time-consuming bug analysis to understand the root cause,

- bug triage and coordination between multiple teams,

- additional development effort for the fix,

- repeated testing in different environments,

- extra work in release management,

- and lots of apologies to angry customers.

Each of these steps adds to the overall cost. When they are combined, the total cost of removing a single medium-complexity defect can amount to several thousand euros. Across a portfolio of systems, this is how the cost of poor QA quietly grows into a major problem in insurance industry.

Effective QA automation identifies catches defects early – and discreetly

Shortly after resolving the bug, the insurer decided to purchase GoQu. Much to their surprise, the software detected the bug immediately, when scanning their pre-fix code.

There would still have been work to do: the bug would have had to be fixed and retested. However, there would be no late-stage triage, no emergency retests, no release firefighting and no database clean-up. As a result, the total remediation cost dropped to around a quarter of that in the poor-QA scenario. In other words, QA automation and code analysis reduced the cost of fixing this defect by around 75%.

From abstract “quality” to concrete financial numbers

What makes this comparison powerful is that it quantifies the financial impact of 'better QA'. Rather than discussing test coverage or defect density alone, the insurer can see the financial impact of better QA:

- how many additional activities are triggered when a bug is not identified until the late stages,

- how these activities accumulate as remediation cost and effort,

- and how much can be saved when QA automation in insurance identifies issues early.

For the Japanese insurer, this transformed QA from a pure cost centre into a cost-avoidance and risk-reduction function. Investments in test automation, engineering practices and tooling could now be justified with numbers rather than intuition.

Conclusion: why test automation in insurance is a direct lever on cost and risk

This case study shows that the cost of fixing a bug in insurance core systems is not fixed. This cost depends heavily on the maturity of your QA automation and code analysis approach. Organisations that rely on manual testing and late detection end up paying multiple times over for analysis, coordination, testing, release and recovery. Those that invest in quality assurance automation pay once, early on, and then move on.

For insurers running complex policy, billing or claims platforms, the difference quickly adds up to hundreds of thousands of euros over the lifetime of a system. Strengthening QA automation in insurance is not just about cleaner code; it is a concrete way to protect margins, reduce operational risk and free up budget for real digital innovation.

Authors of the article

Davide Santonocito - IT Consultant, AI Engineer & Technical Leader at Sollers Consulting

Davide Santonocito - IT Consultant, AI Engineer & Technical Leader at Sollers Consulting

Technology & Market Insights

GoQu, GOSU

The essential role of Code Analysis and Quality Assurance in the Insurance Market