Insurers are very much like recording studios from the 80s and 90s. Compare insurance to a recording studio, like, for example, Universal.

Music is distributed in the form of albums. And it is the studio that decides which songs are going on which album. And if you, as a customer, want to listen to a specific song, you need to buy the whole album, which was compiled by the studio. It resembles the creation of insurance products – we put several risks together and customers who need only a part of them still have to buy the whole product.

Then iTunes came along– a step in the right direction.

Customers can now select and buy each song individually. iTunes resembles modern InsurTechs – straightforward products, simplicity of the sales process over insurance know-how. But for some reason this model was not the final form of evolution in the music industry. This reason is called „choice overload“.

In 2000, psychologists from Columbia and Stanford Universities published a study about jams. On a regular day at a local food market, people would find a display table with 24 different kinds of jams. Then on another day, at that same food market, people were given only 6 different types of jam. Obviously, the first table generated much more customer attention. But the second generated more sales. In fact, it was 10 times more!

Choice overload makes customers hover around more but purchase less.

Choice paralyzes the consumer. This issue has already been solved by the music industry. Specifically, by Spotify.

Spotify not only offers each song individually, but also makes it possible to create playlists, and there is a new automatically recommended playlist every week. In fact, three different Machine Learning mechanisms are applied, so that each Spotify user gets a fully personal playlist each week. This model, let‘s call it „Guided freedom of choice“, is not only interesting from the technological point of view, but also leads to great business results.

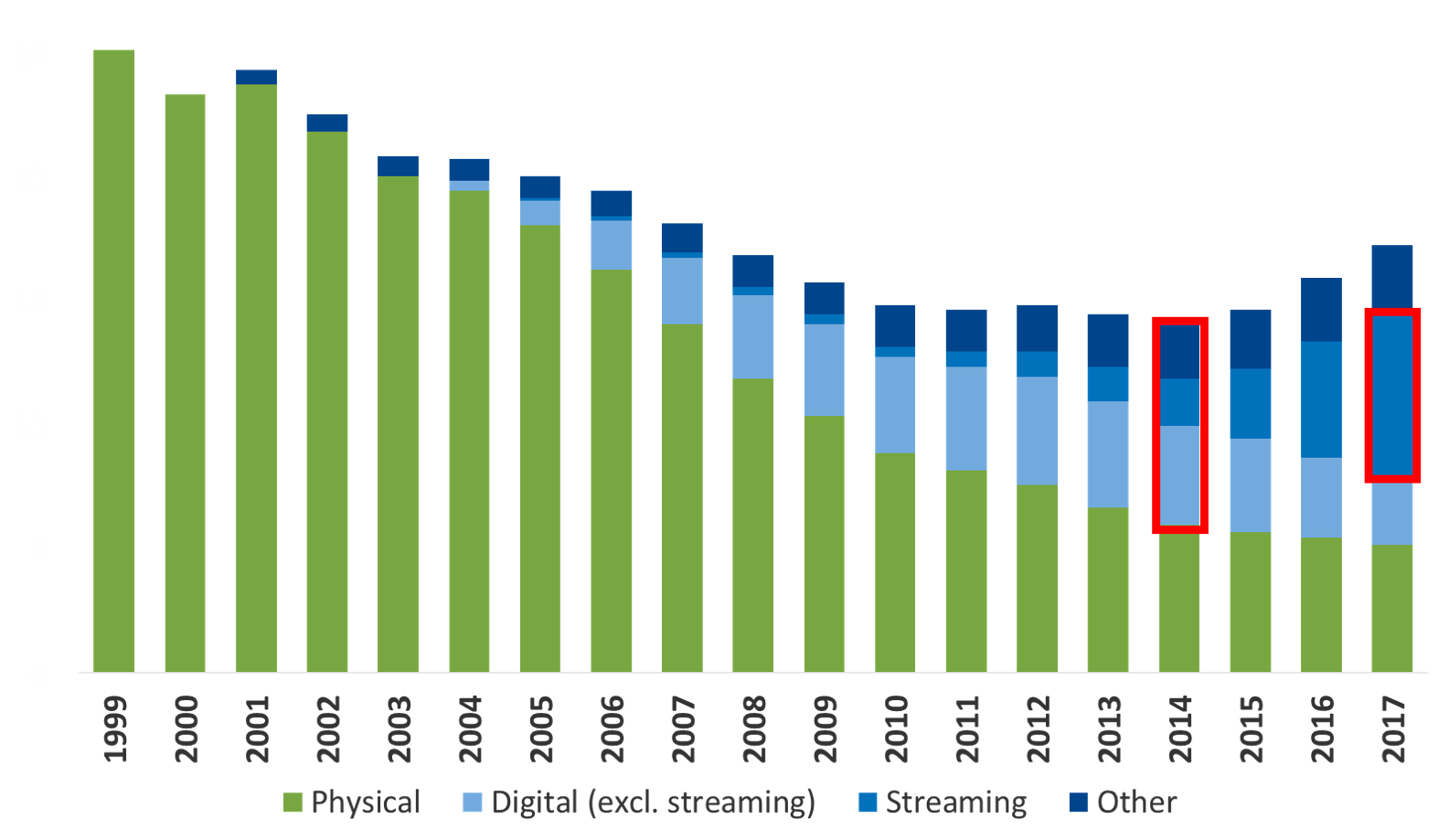

For the music industry, digital seemed like a niche at first, just like it is for insurance nowadays. But look what happened.

In 2014 digital distribution caught up with physical distribution, and already in 2017 streaming itself became the biggest channel.

“Once these changes gained pace, they became incredibly fast.”

A similar trend in unfolding in insurance. There are, of course, many differences, most notably strict regulations, which mean that digital revolution in our industry happens slower and will have to be different from the journey from Universal to Spotify. Nevertheless, it is an inevitable direction.

Discussing these topics with many insurers on different markets we identified a pattern of 4 distinct digitalisation types and came to the conclusion that, as the insurance industry, we should be able to serve the digital customers digitally, and the traditional customers traditionally – however they wish, without forgetting the underlying principles of our industry.