Banks are not fully exploiting the potential of bancassurance. A survey conducted by Sollers in collaboration with Ipsos, shows that 44% of customers say that they are open to buying insurance from a bank. Using insurance software technology and APIs, banks will be able to increase their presence in the insurance business market.

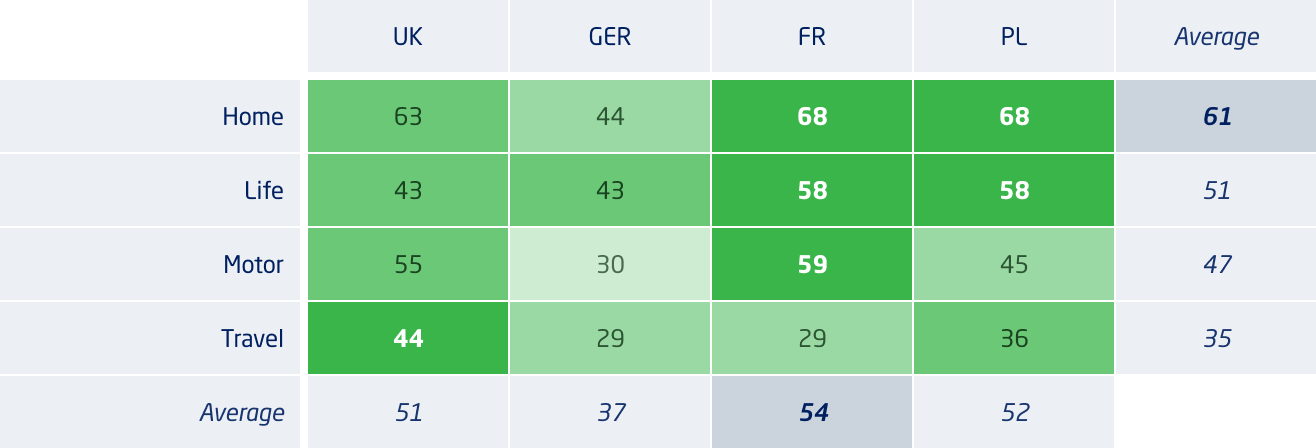

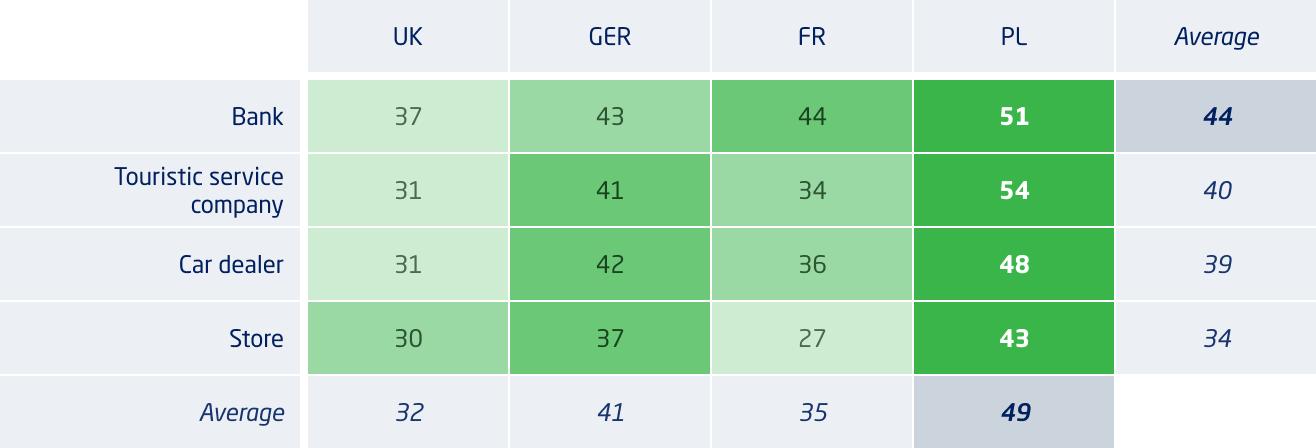

Surveys of 3,200 customers from the UK, Germany, France and Poland, conducted by Sollers Consulting together with Ipsos, show that customers are more likely to buy insurance from banks than other alternatives such as tourism service providers, car dealers or retail outlets. In these surveys, the approval rates for banks range from 37% in the UK to 51% in Poland (Figure 1). When it comes to buying insurance from a bank, 61% of customers are open to home insurance and 51% would buy life insurance (Figure 2). The approval rates for motor insurance (47%) as well as travel insurance (35%) are significant. This fact is not sufficiently recognized by the banking sector.

“Insurance can be a very profitable business for banks. But it requires an experienced insurance team on the banking side and the right technology”, comments Piotr Pastuszka, Senior Manager at Sollers. “Insurance is for the banking industry so attractive because it serves as an opportunity for additional customer services and cross-selling.”

Bancassurance customers are most interested in home insurance. It seems that home insurance is more predominant than life, motor and travel insurance across the board. Even though home insurance is not as popular in Germany compared to France, the UK and Poland, it still has a higher approval rate, with 44%, than the rest of the market. In the UK, non-traditional distribution channels are slightly less well received compared to other markets, but home insurance is seen as the most suitable product for these channels. Polish insurance customers are the most open to alternative forms of insurance distribution, with an approval rate of 49%. This is 8 to 17 percentage points higher than in the UK, Germany and France.

“Banks have started to follow long-term strategies in their insurance business and increasingly sell insurance as a stand-alone product,” explains Patryk Nowak, Lead Consultant at Sollers. “But the financial institutions still have a way to go to fully exploit the potential. There is a strong need in digitising bancassurance. Banks must start to invest in insurance technology to expand their insurance footprint.”

Graph 1

How open would you be to buying add-on insurance from the following listed channels (percentage of people who would buy or certainly buy)

Graph 2

Percentage of bancassurance customers interested in insurance products