Executive summary

- AI Opportunities in Insurance:

- Customer Support: AI-powered chatbots provide immediate responses, reducing wait times and enhancing service quality.

- Claims Management: Automation accelerates claim processing, lowering costs and improving the customer experience.

- Fraud Detection: Machine learning identifies patterns and anomalies to flag potential fraud efficiently.

- Dynamic Pricing: Real-time data enables personalized premiums based on individual risks, enhancing fairness and transparency.

- Types of AI Agents:

- Support Agent (AI Agent or copilots): A tool, designed to work with a human involved, helping them to focus on what matters most. Like a hammer, essential but won’t build anything on its own.

- Autonomous Agent: System, built to be self-sufficient can execute tasks and several tasks in a row with little to no human intervention.

- Agentforce:

- A groundbreaking digital labor platform from Salesforce that allows enterprises to build and customize autonomous AI agents for diverse departments. Agentforce enhances efficiency and productivity by automating complex tasks and integrating seamlessly with the Salesforce ecosystem.

- Transformative Impact on Insurance: By leveraging Agentforce, insurance companies can revolutionize operations, providing superior customer service, expediting claims processing, and effectively detecting fraud. This AI-driven approach ensures insurers remain competitive in an evolving market.

- Advanced Capabilities: With features such as Retrieval-Augmented Generation (RAG) and advanced reasoning capabilities, Agentforce delivers precise answers and orchestrates actions for complex, multi-step queries. This ensures interactions are both accurate and context-aware.

How AI can help insurance companies

AI is rapidly transforming various industries and even our daily lives, bringing many benefits we could have only imagined not so long ago. In the financial sector, for example, AI has improved risk management by automating credit analysis and fraud detection processes. In logistics, it has enabled dynamic supply chain management and optimised transportation routes. These are just a few examples of how investments in AI can be a key factor in increasing competitiveness.

The insurance industry appears to be just at the beginning of its AI transformation. To better understand insurers’ perspectives, Sollers Consulting has conducted a survey among insurers from France, Germany, Switzerland, and the Nordics region. The survey results shed light on several areas within the insurance industry where there may be still significant room for AI-driven innovations, especially in the following aspects:

-

FNOL process optimizations by chatbots and AI Agents

-

AI-powered conversation flow guidance with the ability to read customers’ emotions and feelings for call centre representatives

-

Document recognition for underwriters

From analysing vast data sets to automating complex processes, AI technology can significantly change the way insurance companies could operate. The right implementation of AI means greater efficiency, exceptional precision in operations, and, as a result, top-tier customer service.

Insurance trends 2025 - Sollers Consulting report

- Data from 16 markets, including Americas, Europe, and Asia

- interviews with industry executives: in-depth conversations with insurance leaders and professionals;

- 90% of accuracy for our previous report insurance trends report

Three ways of interacting with AI

With the exception of science fiction books and films, AI is mostly mentioned in context of solving a problem using a Large Language Model, which is just one form of AI. We will concentrate on this topic in this article due to the current excitement that has been generated by the revolution in LLM models and the combined concept of processes automation.

Large Language Models

The Large Language Models’ ability to produce structured content is vital for integration with the application logic, allowing for programmatic control. At this stage, they act as instruments facilitating data processing and generation in ways that were previously unachievable through programming (e.g. using regex).

"Stop," you will say, "chatbots have been around for a while." Yes, they have been around in some form. Think back to the time you tried to check the status of your package on the courier’s website, and the chatbot was unable to understand your inquiry. After a few minutes of fruitless typing, you were transferred to a human. How are today’s chatbots different? The old chatbots were unable to understand the context unless they were configured to do so, as they had to be programmed or configured for each potential query. For instance, LLM does not require programming to configure a response to the following: "Hey’, ‘Hi’ or ‘What’s up?’

Autonomous AI Agents

A support agent (sometimes called ‘copilot’) is a concept where LLM assists a human to complete a specific task. This could be code review for a developer working on a new feature, or a summary of the entire communication history regarding the complaint. The function of a support agent is to increase the efficiency of human work, provide additional data or evaluate concepts. No task is performed autonomously, only suggestions and recommendations. However, the final decision is made by a human, and it is their responsibility to make that decision.

As you may have guessed, autonomous agents are another step into the future, because, by definition, they do not need to involve humans. It is, however, highly recommended to maintain a human touchpoint after the autonomous agent has made a decision, or to delegate tasks that do not require such confirmation or double-checking.

What is the difference between LLM and AI agent?

So how is the autonomous agent, "AA," different from ChatGPT? The main difference is that in our interactions with "Copilot" we send an input message and wait for a response. One or more communication sources are specified. The workflow of AA is more complicated, as it can be described as:

- Data input – from one or more sources.

- Analysis – requires loading memory and/or internet access. In this way we go beyond the introductory knowledge of the model and ensure that the model is kept up to date to make more accurate decisions in the later stages. It can be described as the "thinking" or "understanding" stage.

- Planning – involves combining the previous analysis with a list of available tools, databases, or even other agents. This is used to create a list of actions to be taken in subsequent stages.

- Action – the model determines the next step and gathers feedback based on the analysis result, a plan, and available skills.

- Response – the final response requires an analysis and reporting of the actions.

It is also clear that we are no longer discussing simple tasks in a question and answer format, but rather novel architecture and application design patterns. Interestingly, this programming is reminiscent of classic applications, with LLM playing only a limited role. Nevertheless, the data itself, different file formats, database organisation or search strategies are the key success factors, in addition to the actual coding. This means that the development of an autonomous agent should be seen as a comprehensive transformation, rather than a quick fix or a short implementation for three months.

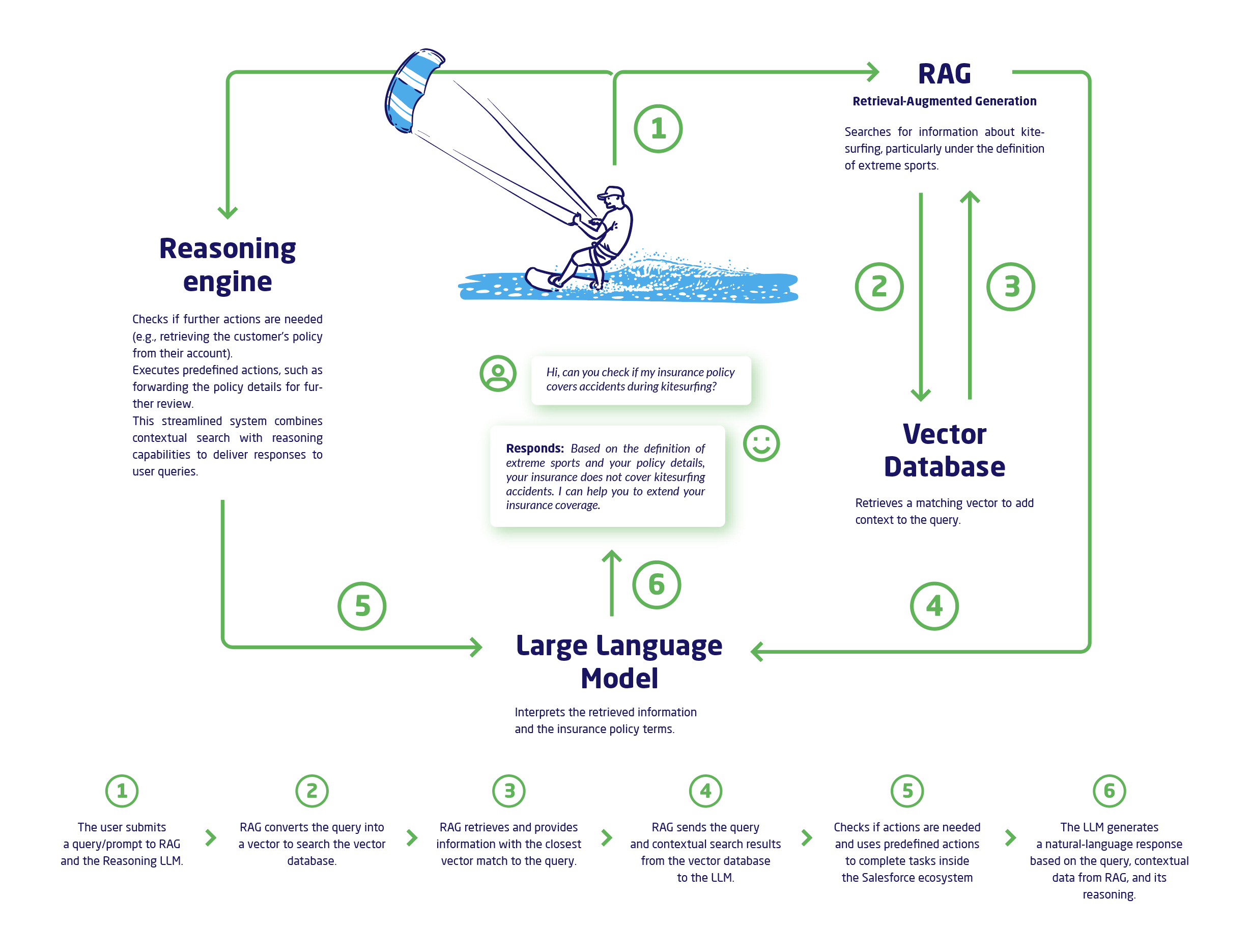

Salesforce Agentforce working model

It is easy to get lost in all the AI tools that have become available in the last 4 years. AI research is in its golden age. As well as the number of papers is being published each year, the number of models available is growing. There are over 1,2 millions of AI models available on Hugging Face – The AI community building the future. And it is an impossible task to keep up with this growing library.

It is not so easy to create a customer-ready architecture for AI solutions. The rapid pace of change in AI technology often means that the planned investment will be using outdated technology or architecture when it goes live.

The need for out-of-the-box AI solutions has been quickly recognised by leading software providers such as Salesforce. Agentforce is a great example of how to simplify the introduction of AI into the CRM platform and help Salesforce clients take advantage of this modern technology, especially LLMs. There are few architectural tricks used in Agentforce that transform simple LLM into a powerful automation tool for platform users. As an official Salesforce implementation partner we can help your company with adapting Salesforce to your organisation.

Salesforce AI modernisations

The first architectural trick that Salesforce uses is RAG. When OpenAI released publicly its first ChatGPT it had a very limited context window that could been taken into account when answering a question. It was obvious to everyone that the context window needed a solution that would extend the capabilities of the LLM. This is how the RAG was invented. In recent years, the context window has grown from 1 page to hundreds of pages but there is still problem of consistency (if LLM can find information in the big context window) and of cost (big context window = higher cost). Both of those problems are mitigated by RAG itself.

How does Retrieval Augmented Generation work

RAG uses a system that is very similar to AI facial recognition software. In facial recognition we have a database of faces connected to each person. This database isn’t stored as an image but as complex mathematical vectors. Each time someone uses the facial recognition software their face is also processed into a vector. By comparing the new vector with the vectors stored in the database, we can return a value of vector similarity calculated in percentage. We then use this to decide, whether it is the same person or not.

Similarly when you use RAG you store your documentation in chunks, with a vector calculated for each chunk. When a question comes in from a user, it is also vectorised and this new vector is compared with the vectors in database. After that the system takes all similar vectors from the database and pulls the content (chunk) behind the vector into the context window of the LLM. This way we only have relevant information in the context window, so it is more likely that LLM will find the answer in there, and it costs less to process.

Salesforce Atlas Reasoning Engine

The second architectural trick Salesforce uses in its Agentforce is the Reasoning Engine. This is an expensive but powerful tool for LLM prompting. In the basic scenario when you talk to LLM, it only answers based on your prompt. LLM doesn’t “think” about what exactly do you want and the outcome should be, what steps are necessary to accomplish the task, etc.

By using prompt techniques such as Chain of Thoughts LLMs become more capable and accurate when presented with a task. When using Chain of Thoughts you design the LLM to ask itself a few questions in the background before answering the question or the task that the user has delegated to AI. These might be questions such as “what is the desired outcome of this prompt?” or tasks such as “define the steps needed to achieve the desired outcome”

This results in higher cost because you have to process the same question several times before generating an answer but it also generates better results which means that the overall conversation can be much shorter and more user- friendly.

A very important aspect of the Agentforce Reasoning Engine is that it can also perform pre-defined tasks in the Salesforce ecosystem. It can download related context from the system, add comments to existing tasks/cases/leads, update delivery time, and update customer contact and many other OOTB actions. It can also execute completely custom actions and flows that are programmed by Salesforce administrators or developers.

Using these two architectural tricks embedded in the Salesforce ecosystem creates a tool that is far more powerful than simple LLM on its own. Agentforce is a great example of using new technologies to enhance the existing product with AI.

AI use cases in insurance

In an era of fast technological advancement, the insurance industry is at a critical crossroads. Leaders must decide whether their organisation wants to gain a competitive advantage, thrive in a particular area, or automate a process that frustrates people.

Automated customer support

One of the most significant applications of AI in insurance is automated customer support. Traditionally, customer service involved long wait times and repetitive inquiries that frustrated clients and drained resources. However, with AI-powered chatbots and virtual assistants, insurers can now provide immediate responses to common queries regarding claims, complaints, disputes, or information requests. These systems are designed to handle multiple interactions simultaneously while maintaining a consistent level of service quality. By freeing up human agents from repetitive chores, businesses may shift their focus to more complicated consumer needs that require personalised attention.

AI in claims management

Equally important is the use of AI in claims managment and processing. The journey from filing a claim to receiving payment is often riddled with inefficiencies and delays due to manual systems that require numerous verification steps. Using machine learning algorithms, insurers could dramatically automate these processes—from intake to payout—resulting in faster resolution times for clients and lower operational costs for the organisation. In addition, by combining historical data with real-time information about incidents or claims patterns, insurers can make better-informed judgements and detect potential fraud more quickly.

AI fraud detection

Fraud detection has become a key concern in the insurance industry, as fraudulent actions cause huge losses every year. Here too, AI could help build an important risk mitigation strategy by examining massive volumes of data for trends or abnormalities that indicate fraudulent behaviour. Machine learning models can be trained on historical claims data to detect irregularities, such as unexpected claim amounts or disparities between reported incidents, and flag them for further investigation before they cause financial loss.

AI in insurance underwriting

The underwriting process could potentially benefit significantly from advances in AI technology, as risk assessment becomes not only more accurate but also significantly faster than old techniques. Insurers are using algorithms that can sift through large databases, historical records, and real-time market conditions to accurately assess the risk associated with individual applications. This level of detail allows underwriters to create personalised quotes based on individual risk characteristics, rather than relying solely on generalised statistics.

AI-backed dynamic pricing

Dynamic pricing modelling is another area where artificial intelligence could shine brightly in today’s insurance operations. Instead of fixed rates based on broad categories such as age or geographic location, which often fail to reflect actual risk. AI allows insurers to adjust pricing in response to real-time data inputs related both directly (e.g., driving habits) and indirectly (e.g., weather conditions or drug approvals). This adaptability not only helps to mantain competitiveness, but it also promotes transparency between insurer and Policyholder; clients feel more valued when their premium reflects their true risk levels rather than arbitrary ratings.

Tailored sales journeys

Sales coaching powered by artificial intelligence provides organisations with greater insight into agent productivity and lead management capabilities aimed at maximising conversions without compromising the integrity of client relationships, which is critical in an inherently trust-driven industry such as insurance services, where word-of-mouth recommendations are essential. Agents receive tailored training recommendations based on identified weaknesses presented during individual sales journeys, which are made available through detailed insights derived from performance metrics tracked throughout the customer life cycle.

Customer retention modeling

Proactive client retention methods are another key application area suitable for research using modern technology. Rather than waiting for customers to express their displeasure before responding, as was traditionally done, insurers using machine learning techniques are proactively engaging customers through personalised outreach campaigns aimed at reducing churn rates. By studying behavioural patterns derived from previous encounters, as well as demographic variables, the decisions can be significantly influenced without the need for a sophisticated Big Data project each year.

Personalised policy renewal process

Policy renewal the management of policy renewal has been made smoother through automated capabilities powered by advanced algorithms, allowing for timely reminders to be sent directly to existing policyholders well in advance. Offerings could include tailored terms and discounts designed just for the customer to ensure long-term loyalty.

Future of AI in insurance

Trends and forecasts

As we move deeper into an era dominated by technology's influence on every aspect of modern life, it’s becoming increasingly clear that incorporating innovative solutions such as Artificial Intelligence is critical to improving the customer experience, mitigating risk and optimizing costs. Ultimately, it may take years to reap the full benefits of Autonomous Agents, as the most recommended way to use AI today is through human-robot collaboration. By augmenting humans with AI's processing power and access to massive datasets, employees can become much more accurate and effective on a daily basis.

After analyzing the survey results, we conclude that the use of AI is becoming crucial for staying competitive and meeting changing market needs. A group of insurers surveyed by Sollers Consulting have identified 3 areas that will have the greatest impact on market competitiveness when it comes to the use of AI:

- Improved customer experience

- Efficient claims handling process

- Increased claims handling robustness

Other important aspects identified by our respondents include back-office improvements, strengthening market position, and improving sales efficiency. Insurers want to respond quickly and effectively to market needs and a rapidly changing environment. Human collaboration with the newest AI capabilities sounds like a perfect match.

Risks and challenges

Unsurprisingly, implementing the latest and lesser-known technologies comes with its own set of challenges and risks. The insurance sector is highly and strictly regulated, especially when it comes to the processing of personal data. Some cloud-based, untrusted and vague solutions can rightly raise concerns. Around 80% of insurers surveyed in our AI survey cited compliance as a key risk factor for the adoption of AI in their organisations, which is actually preventing them from fully embracing this technology. To ensure that customer data is secure and not exposed, it is critical to implement AI solutions using trusted data anonymisation layers and secure gateways with zero data retention on the LLM side.

Another highlighted challenge is the huge implementation cost and complexity of incorporating AI into existing processes and pipelines, and integrating AI with existing systems, which are often highly-customised and sometimes legacy. Implementing AI also requires a team of specialists qualified to drive such transformation with the required accuracy and care. Insurance IT departments are often fully engaged in the ongoing maintenance of existing IT infrastructure, leaving no additional resources for innovation. In this case, low-code or even no-code platforms such as Salesforce with its Agentforce can be a great idea because of human- language interaction, where anything people can describe might be done by AI agents.

The common human fear of change is also an important factor. Organisations and their employees are used to certain processes and ways of working. They often find it difficult to accept new tools and capabilities, even if they can bring many benefits and improve their day-to-day work satisfaction. It is worth building the right understanding and positive attitude towards AI throughout the organisation.

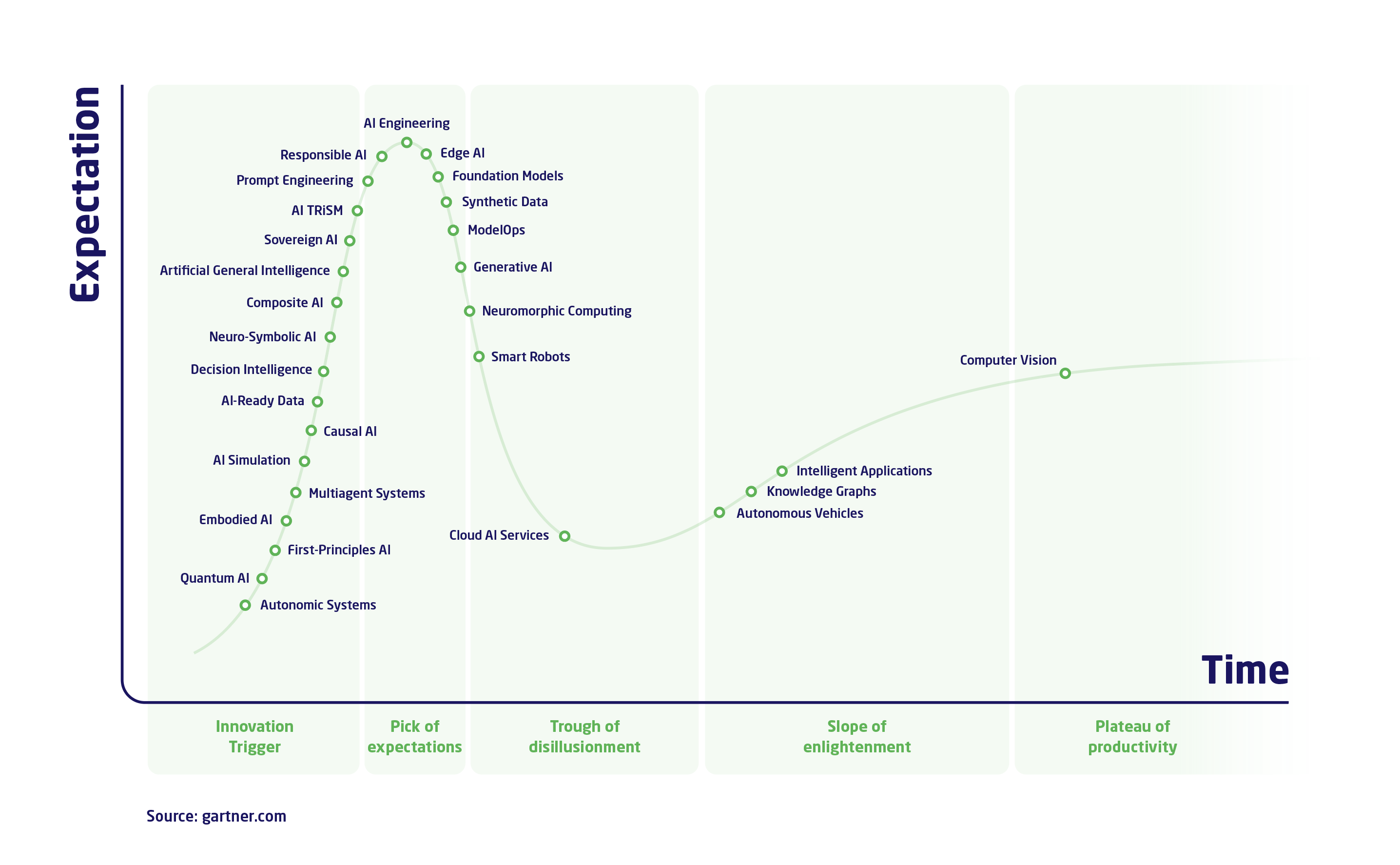

Beyond AI hype

When new disruptive technologies emerge, it’s worth looking at other solutions in the same field that have already reached the productivity plateau. While generative AI is still making headlines, much less is being said about computer vision solutions that process images to extract specific information (e.g., colour, facial recognition, identifying fractures in X-rays). These technologies have immense potential for automating business processes. They deserve greater attention due to their mature toolsets for building functionality, more transparent marketing practices, access to seasoned professionals with years of experience, and a significantly larger number of successful implementations. Another key advantage is the slower pace of development, which ensures that the solutions implemented today won’t be obsolete in two years' time.

How OCR and computer vision can support insurance processes

The lowest hanging fruit in computer vision is OCR. The origins of Optical Character Recognition date back to 1914, and today there is an endless variety of OCR tools capable of reading all sorts of documents, such as ID cards, invoices, medical records, and more.

One of the most common and trusted use cases for OCR in finance is the ability to read data from scans and photos of invoices and enter it in the right places in the system. This simple task, which many of us are used to doing, can save people time and make financial transactions more efficient, error-free and pleasant.

In the insurance industry, OCR can be used to automate various stages, particularly in underwriting and claims processing, where document data is automatically captured into systems. Tools such as Mulesoft and Agentforce simplify OCR implementation by using LLMs to create symbiotic solutions that extract only the data you need from documents.

However, computer vision is a much broader branch of AI and is not limited to OCR. For example, motor insurance companies manage huge data sets related to vehicle damage assessments. These datasets can be used to create computer vision models that can automatically estimate repair costs based on photos of damage and vehicle data. This reduces the need for human assesors only to exceptional cases. Such assessments can not only automate the claims process but also help identify potential cases of insurance fraud. Similarly, in the health insurance sector, computer vision models can be used to detect diseases and injuries that are visible on X-rays and ultrasounds. However, this is a much more complex area due to the regulations surrounding medical data.

In property insurance, computer vision systems can also be extremely useful, especially for object recognition applications. Object recognition models can identify features in images such as cracks, water damage, fire damage, and more. This capability allows insurers not only to verify claims reported by customers but also to assist in property inspections prior to issuing policies.

Conclusion

AI offers the insurance industry great potential to completely change the market reality. Taking advantage of this unique opportunity requires thoughtful and gradual action - from very simple and easy-to-implement small projects to major transformations.

Some organisations may consider building their own AI infrastructure, but as we have shown in this article, this requires a lot of attention and resources. Such an investment will also be very large initially, and the payback period can be quite long. A better approach may be to use one of the market-ready solutions such as Agentforce.

By using Agentforce, insurers can quickly bring value to the market and grow their business faster than their competitors. Other technical aspects such as custom AI models, continuous retraining, security, sharing models, access to specialised AI engineers, costly scaling and readiness for rapid change are all managed by Agentforce on the Salesforce platform. By investing in an off-the-shelf solution, organisations can quickly take advantage of the latest technological advances and get to market faster with new ideas and a new way of serving customers.

The insurance industry is on the cusp of a great opportunity where humans and AI agents can easily collaborate and create the next great stage of business transformation. Those who will neglect the opportunity will be left behind with a higher cost ratio, deteriorating risk portfolio, and market share.

Did you find this article interesting? Get in touch with our experts!

Hubert Młodzianowski - Head of Salesforce Competence

Mariusz Halaczek - Salesforce Architect