Insurance industry trends 2025

The Predictions Report 2025 is based on comprehensive data and insights from various sources, including:

- labour market analysis: a review of 1,758 job postings from 127 insurance companies across 16 markets, employing approximately 1 million people;

- insights from business and development teams: contributions from our teams across the Americas, Europe, and Asia;

- interviews with industry executives: in-depth conversations with insurance leaders and professionals;

- industry reports: data and findings from research institutions, financial organizations, and insurance companies;

- Sollers Insurance Database: a valuable resource providing detailed industry information.

The diverse data collected from key markets, including North America, the UK, the London Market, the DACH region, France and the Benelux, the Nordics, Central and Eastern Europe (CEE), Japan, and Australia, enables us to gain a deeper understanding of the goals, challenges, and opportunities currently shaping the insurance sector.

Key insights for insurance C-level roles

Did you know?

- General insurers are set to have a strong year in 2025, buoyed by generally hard markets, improved investment opportunities, and a robust, growing economy.

- However, the development of both insurance business and technology will face challenges, primarily due to increasing political and regulatory instability.

- Data management will remain a top priority for insurers in 2025, with a growing shift towards cloud technologies and cloud-based solutions.

- The use of AI and Generative AI (GenAI) will soar, driving automation and efficiency, especially in areas like document management, chatbots, claims processing, and fraud detection.

- To navigate the volatility in insurance markets and build on advances in data management, insurance companies will make significant efforts to modernize their pricing technology.

And that’s just the beginning. There’s much more to explore. Fill out the form to download report.

In which areas insurers will invest in 2025

An analysis of job adverts from companies in the insurance sector provides insight into the prevailing sentiment within the industry and offers a clear reflection of the needs of the companies themselves and their customers. The data indicates a clear global trend towards hiring data professionals, followed by those with expertise in security and cloud technology. However, local markets exhibit varying patterns.

Factors such as political instability, natural disasters, and the evolving landscape of data management may contribute to these discrepancies.

How trends vary over sectors

Global insurance market trends: a focus on AI, digitalisation, and data governance

With the accelerated adoption of AI by insurance companies in North America, data management and data governance will rise to the top of the agenda. Key regional developments include:

- London Market: insurers are expected to invest more than the industry average in digitalisation, particularly in underwriting, claims, reinsurance, data management, and cloud technologies.

- UK: to boost operational efficiency, insurers will prioritise the automation and digitalisation of core processes, with a particular focus on making more effective use of cloud solutions.

- France and Belux: heavy investments in AI and digital transformation will drive modernization, with a special emphasis on APIs as insurers look to modernise their core systems.

- DACH: the primary focus will be on modernising core systems. Some companies will continue with existing core system implementations, while others will launch new projects.

- Nordics: to optimise administrative costs, insurers will concentrate on enhancing the customer experience and advancing digital insurance offerings, with a growing reliance on AI.

- Central and Eastern Europe: under pressure from market dynamics, insurers will increasingly turn to AI-driven change and leverage enriched data as dominant strategies for competitive advantage.

- Japan: general insurers will focus on improving productivity, diversifying distribution channels, expanding digital services, and growing globally through acquisitions and the reorganisation of overseas operations.

- Australia: in response to market demands for more efficient claims handling and customer service, insurers will increasingly adopt cloud technologies to streamline sales and service operations.

Interested in more details focused on your region? Fill out the form to download report.

What we got right in our report for last year

Accuracy of last year’s Report: a strong track record

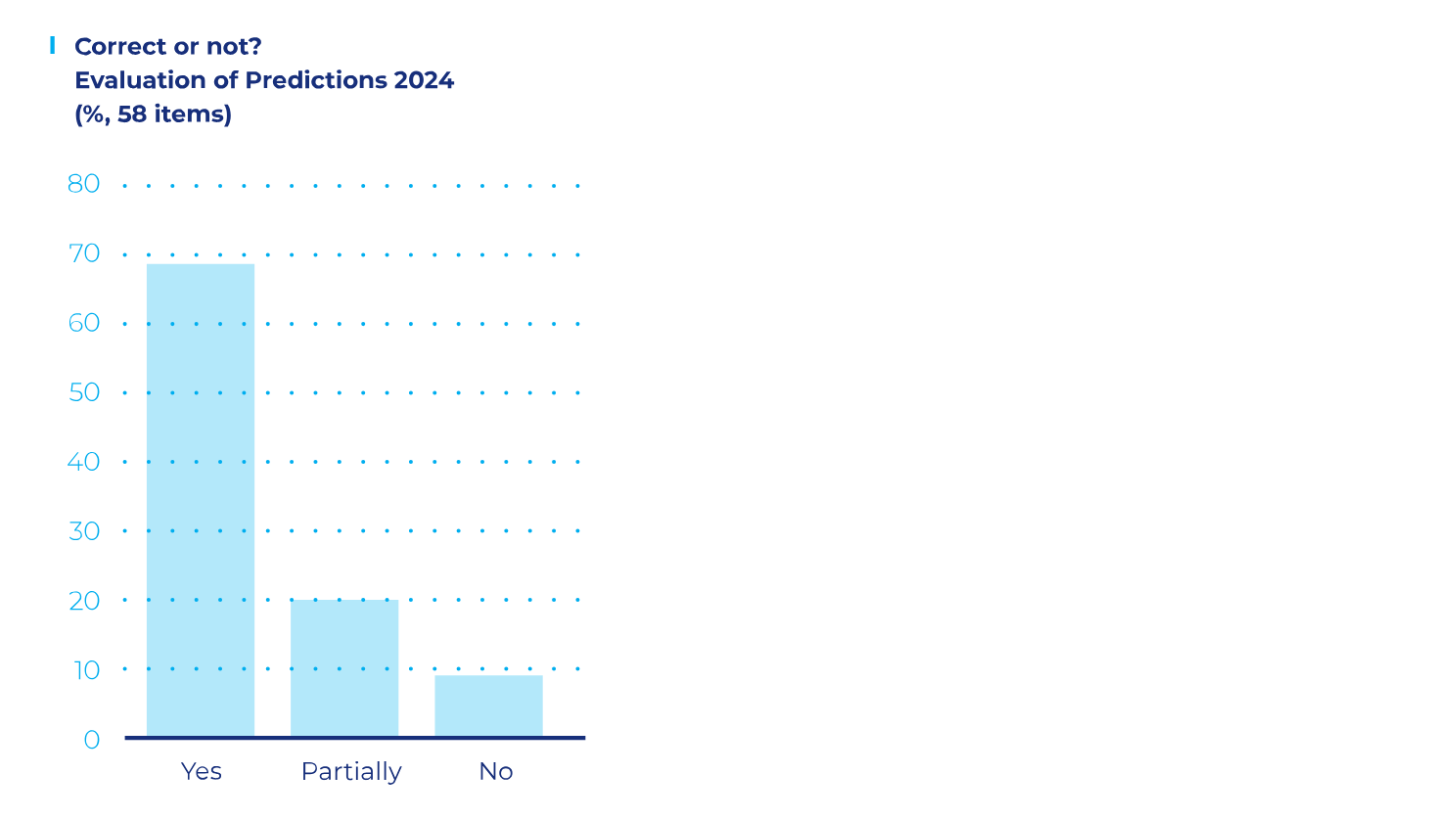

The accuracy of last year’s report was highly satisfactory, with 90% of our forecasts proving to be either fully or partially correct (see graph). Key predictions that proved accurate included:

- the continued trend toward mergers and acquisitions within the industry,

- growing pressure on insurers from rising reinsurance costs, increased exposure to natural catastrophe events, and claims inflation outpacing general inflation,

- the trend of price softening in the UK motor sector, in contrast to the price increases in France and Germany,

- a heightened focus on data management as a strategic priority,

- the ongoing migration of core systems to the cloud, particularly in the US, Australia, and the UK,

- a strong emphasis on data and APIs to drive business transformation.

- the growing importance of automation among Japanese insurers.

To receive the report to your email, submit the form: