How to approach software testing?

It is not uncommon for software projects to fail, sometimes with serious consequences. This also happens in the insurance industry. There are many reasons for this, ranging from errors in the infrastructure to software bugs to improper implementation of functional requirements. Regardless of how diverse the possible causes may be, they are usually due to errors made during software development that were undiscovered and not corrected before the software was released.

The importance of proper software testing

Errors in software are usually detected and eliminated by the software testing process. While tests cannot usually cover all possible errors, they do reduce the error landscape considerably – but at a certain price. Code quality tests can only ensure that the software works reliably if its logic and assumptions are kept up to date with the software and its requirements. Otherwise, tests can produce incomplete results – for example, if the tests created for certain functionalities are not enriched or extended as the tested functionalities evolve. Regardless of the results of such outdated tests, they do not provide reliable information about the correctness of the software.

Solution – test automation tool

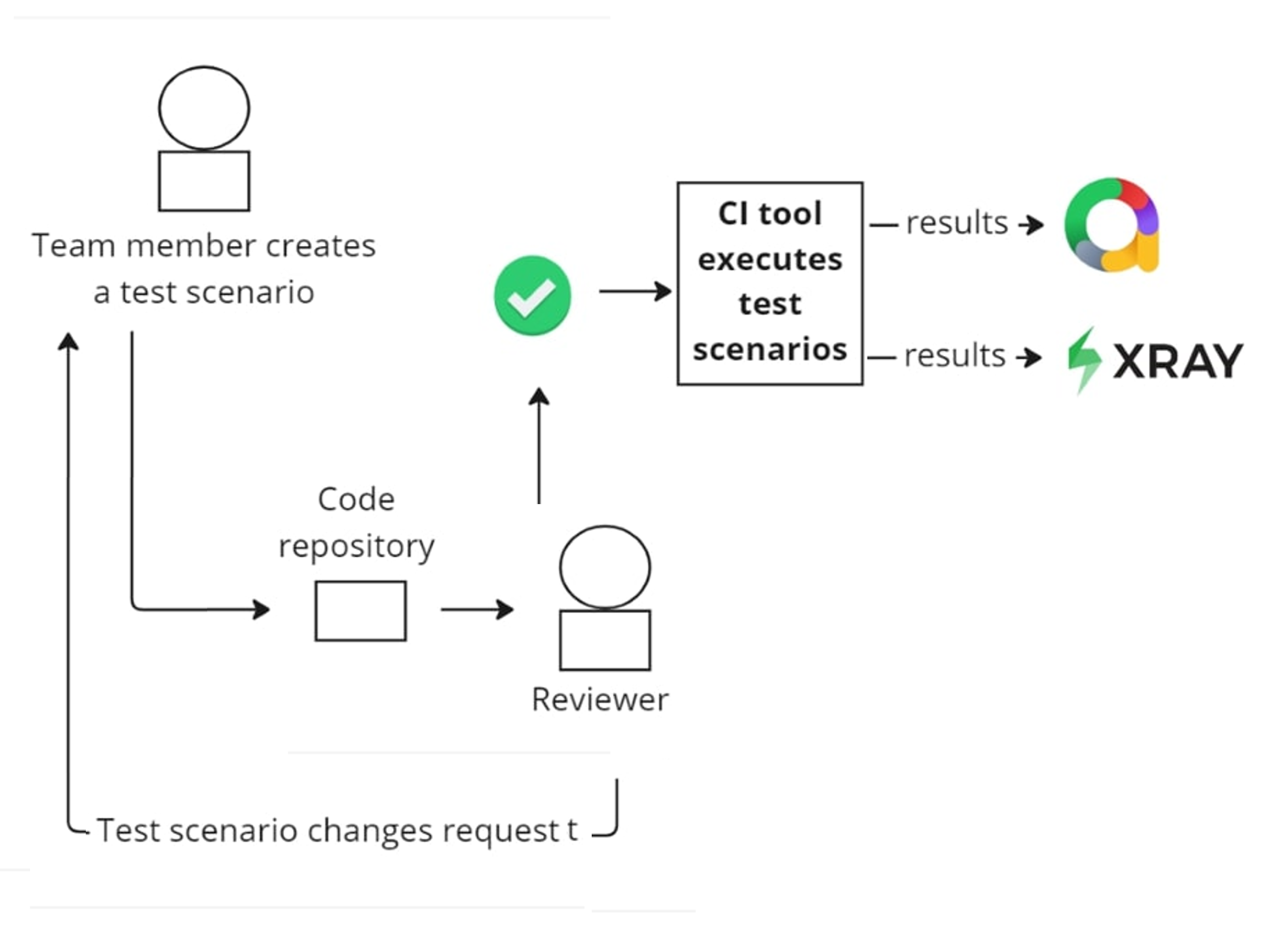

A proven solution to the problem of test obsolescence is to make testing a first-priority component of software. To support software testing for insurance companies using core systems provided by Guidewire and TIA Sapiens, we developed Sollers Business Automation Testing Suite BATS. With BATS, a team member creates a test scenario based on the provided specification. Then the creator (not necessarily the developer) posts the test to the repository where it is reviewed by another team member. Once accepted, the test is submitted to the repository and later executed in a scheduled CI test job. Once the job is completed, the results of the execution are passed to external tools.

Outlook:

As artificial intelligence-based tools become more prevalent, the process of digital transformation will accelerate. As the industry is expected to accelerate its efforts to modernise and transform existing systems, they will become more vulnerable to project risks. It will become increasingly difficult to guarantee software quality. Automated insurance software testing through the targeted use of code quality testing tools will become increasingly attractive as insurers seek to avoid errors in their software and maintain error-free business operations.

Kacper Sołtysiak

Developer at Sollers Consulting