On its way to digital transformation the Swedish insurance industry has a long way to go

The takeover of Trygg-Hansa by Tryg and the merger of Moderna and Trygg-Hansa will accelerate the IT modernization in the market. Swedish insurers want to speed up their digitization efforts as they understand they are behind other industries. At the same time, we see takeovers and mergers on the side of technology providers to strengthen market presence and to boost technological capabilities.

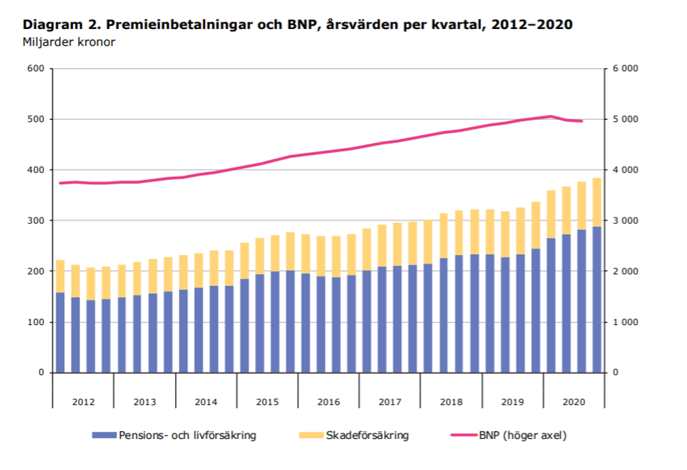

The Covid-19 pandemic has caused insecurity in the global insurance industry and it is still not clear how much insurers will have to pay for claims resulting from business interruptions, event cancellations and many other unexpected calamities. Insurance stocks perform much worse than those of other industries. The Swedish insurance industry, however, turns out to be an anchor of stability in these times. Premium in P&C insurance went up 3,5% and life insurance premium increased even by 11% last year. At the same time the claims burden of Swedish insurers went down significantly as lockdowns reduced the risk exposure in motor insurance and other lines of business.

Insurance must become a driver of digitalization

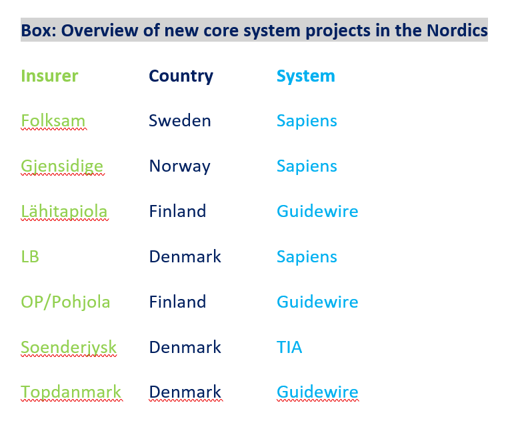

The sound financial situation helps insurers to invest in necessary core system modernization. Seven major Nordic insurers have started implementing new core systems, but companies in the Swedish industry still have a long way to go. In Denmark three insurers have started to implement a new core IT and one has completed it. In Finland two companies have started and in Norway one, the market leader Gjensidige. But in Sweden, which is the biggest market in the Nordics, only one insurer has taken this important step. Länsförsäkringar has been a client of the core system Insis of Fadata for many years but the implementation for personal lines is still on its way. Implementation for commercial lines has not started yet. The insurer If works on a proprietary core system. It will be interesting to observe whether the companies will be able to sustain a competitive advantage with their approach, or at some point consider turning towards a standard solution.

Insurers tend to neglect their core systems as the implementation of new core IT is a considerable effort and takes time. Often it is argued that there is no immediate business case in implementing a new core system. A couple of insurers feel that unpleasant experiences in the past are still too strong as to overcome them. But the industry should be courageous as there are challenges luring, from outside the industry and from inside as well. Insurers need to become drivers of technological development if they want to keep client satisfaction high and be ready to respond to other industries intruding the insurance business.

The industry must resolve three problems:

1. Alignment of IT with business strategy

2. Client-centric approach

3. Driving automation and efficiency

Data for a data driven industry

To address these challenges, insurers need a sound business strategy and a modern core system. Based on this they will be able to make a step forward into the knowledge age we live in. Data, and information it provides, is crucial for the industry’s success. It has already become a foundation that may decide about survival (or not) for those companies that do not adapt in time. Insurers need to use data if they want to provide a Spotify-like digital service to their customers. Insurance has been a data driven industry for long, but the tables and excel-sheets are replaced by real time data. Some insurers have started centralizing their data and creating data lakes. But many companies still struggle with their own data as it is spread among many systems, not accessible and not usable. We see insurtechs coming up in the Nordics that compete with established insurers. These young start-up companies profit on their modern IT infrastructure and pose a significant threat to established players.

On the other hand, there are many insurtechs that provide interesting solutions for insurers. The first questions they will ask is: How about your back-end IT? Are you ready to leverage what we offer?

There are two main approaches to build a new core IT:

1. Monolythic: All functionalities in one solution from a single vendor; there are no integration or compatibility issues, but it might be not the best solution in one or more areas; there is a significant risk of vendor lock.

2. Best of breed: Many systems from many vendors; there are potentially integration/compatibility issues, but it allows to pick the best functionality for each area; the approach can be expensive and difficult to maintain.

Insurers currently experiment around those two concepts that are like water and fire. Some replace multiple legacy systems with a new integrated suite, others try to build IT-ecosystems around their existing legacy systems. We recommend taking a third direction and build a two-speed architecture. Following this approach insurers combine the benefits of a proven backend core with an embedded insurance layer that allows to create digital service ecosystems.

SaaS is a challenge for providers

Today migration to public cloud is a dominant trend across entire Nordics and all key players are either planning for it or already doing it. New cloud-based platforms are popping up. They help speed up digitalization in certain areas, but they do not solve the legacy issue. Cloud is only an infrastructure tool, after all.

The next step in the upcoming five to ten years will be Software as a Service (SaaS). Giving away ownership of core system development requires often deep redefinition of a company’s business strategy and its competitive advantages. It is a challenge, not only for the insurance industry. Core system providers struggle to provide SaaS offering that would be compelling enough to make the move. Probably only the biggest core system providers will offer SaaS as it requires them to take much more business risk than selling only the license.

Sweden is a digitally advanced country, but the insurance industry has not changed in the way other industries have. Business patterns are being severely disrupted in many industries. Clients are more and more accustomed to digital interactions, and new technologies offer innovative solutions to boost efficiency. If companies allow their technical debt to rise, they might get into a position where they are unable to make up for the gap and start to fight for survival Insurers have started to innovate, but they are not yet transforming their business. It will take courage and an agile approach to change that.

https://www.svenskforsakring.se/contentassets/ca423231ac234ece9be59ac0d06b11c8/forsakringsmarknaden-2020k4.pdf

Author: Sławomir Gdyk, Lead Consultant at Sollers Consulting