Insurance clients are much more open to sharing data than the industry assumes. A third of clients are willing to share data for premium discounts, Sollers’ surveys indicate. The business and IT consultancy predicts that insurance companies will step up their efforts to become data driven.

Due to inflation and the cost-of-living-crisis, insurance customers are increasingly open to digital insurance products that require them to share data about devices they use. 34.5% of customers would share data with their insurers to get a more affordable policy, surveys by Sollers Consulting show. Together with IPSOS, the business and IT consultancy surveyed 3,800 insurance customers in the UK, France, Germany and Poland about their dealings with insurers.

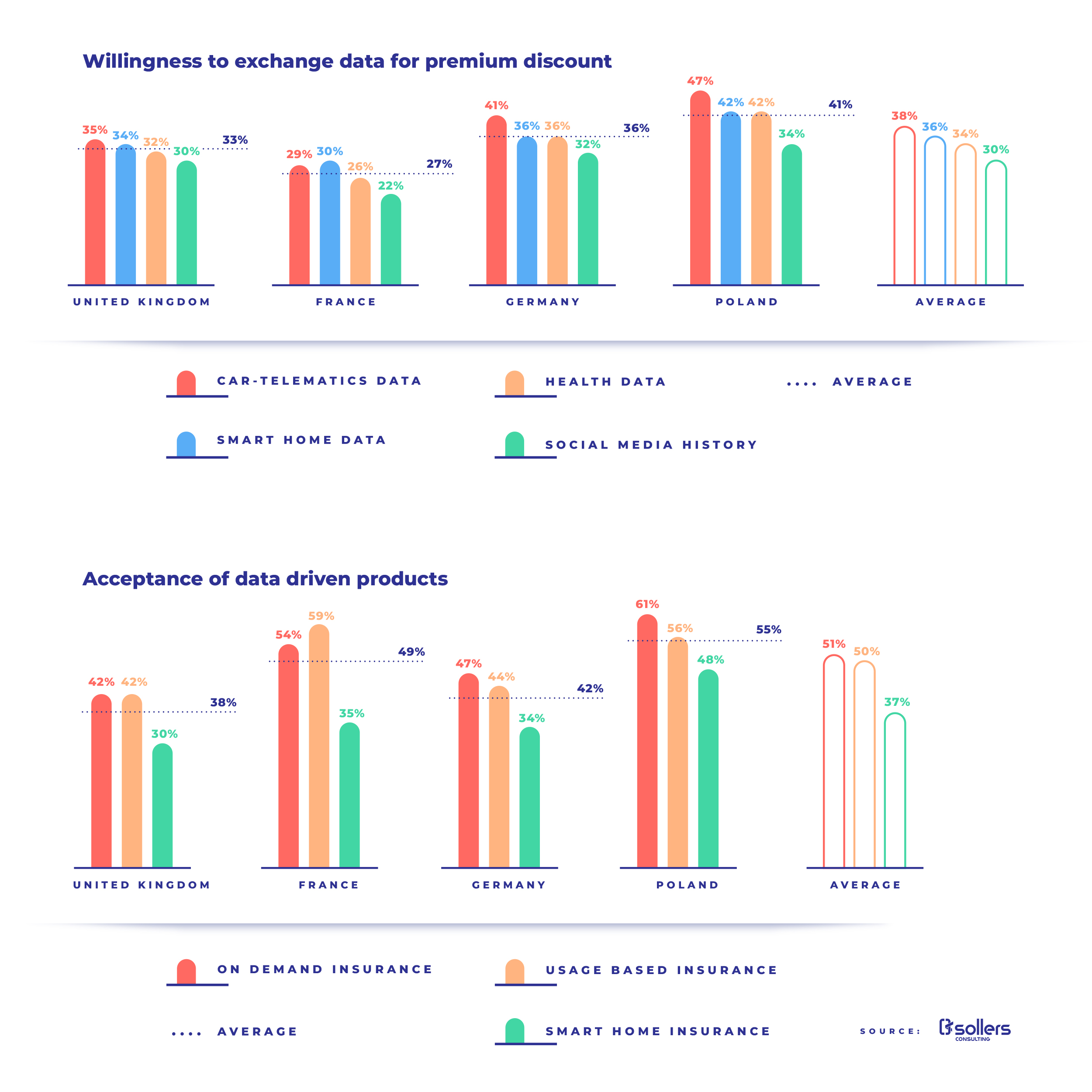

According to the survey, insurance customers in Poland are most open to sharing data to get premium discounts. 41.25% of respondents say they are interested in this option (chart). However, a significant proportion of customers in Germany (36% of respondents), the UK (32.75%) and France (26.75%) are also interested in these options. Through digital insurance products based on the use of data, insurance companies can better assess individual risks and offer cheaper insurance.

“Connected devices and IoT gadgets are producing a rapidly growing amount of data. New regulatory initiatives will allow customers to share their data with other companies. In the insurance sector, this will be beneficial for both customers and insurance companies,” says Mateusz Stasiak, Head of Data at Sollers.

The willingness to purchase insurance coverage via digital products such as motor telematics or insurance on-demand is even higher than simply sharing data. On average, 46% of customers would buy these products, the surveys show. On-demand insurance products that can be switched on and off are the most popular. They have an approval rate of 51%. Usage-based insurance, such as pay-as-you-drive, is almost as popular (50.25%). Here too, Polish customers are more open than their counterparts in France, Germany and the UK.

The most widespread and accepted option of data-driven insurance is car telematics, where driving behavior is recorded via a box in the car or a smartphone. Smart home insurance is less widespread, but still finds great acceptance among customers. About one-third are interested in these products.

“Because insurance costs are rising due to inflation and natural disasters, customers are looking for other options. Sharing data contributes to a better understanding of individual risks and supports prevention. New digital products will lead to more affordable and tailored insurance products. We expect insurers to invest in redesigning their data architecture and in new customer solutions in the coming years,” comments Stasiak.