chatbots

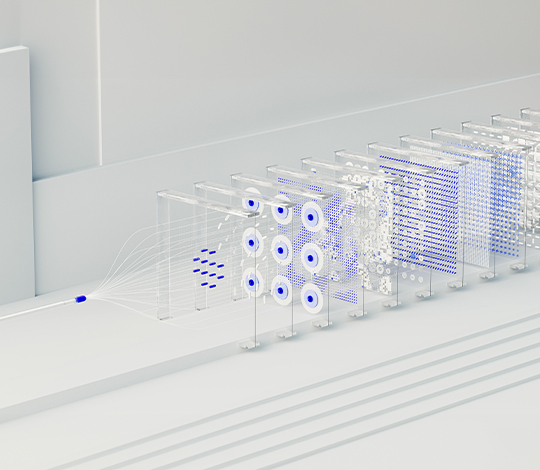

Approach to chatbots: from classic solutions through advanced AI Agents up to Agentic...