Insurance companies might struggle to leverage their data, as it is distributed in various systems. Today insurers have more customer data than ever. That allows them to personalize offers even further and automate repetitive tasks. However, the key is to properly store and manage incoming information. Done right, Insurance Data Management can significantly improve core insurance processes like claims management.

Prepare for effective Insurance Data Management

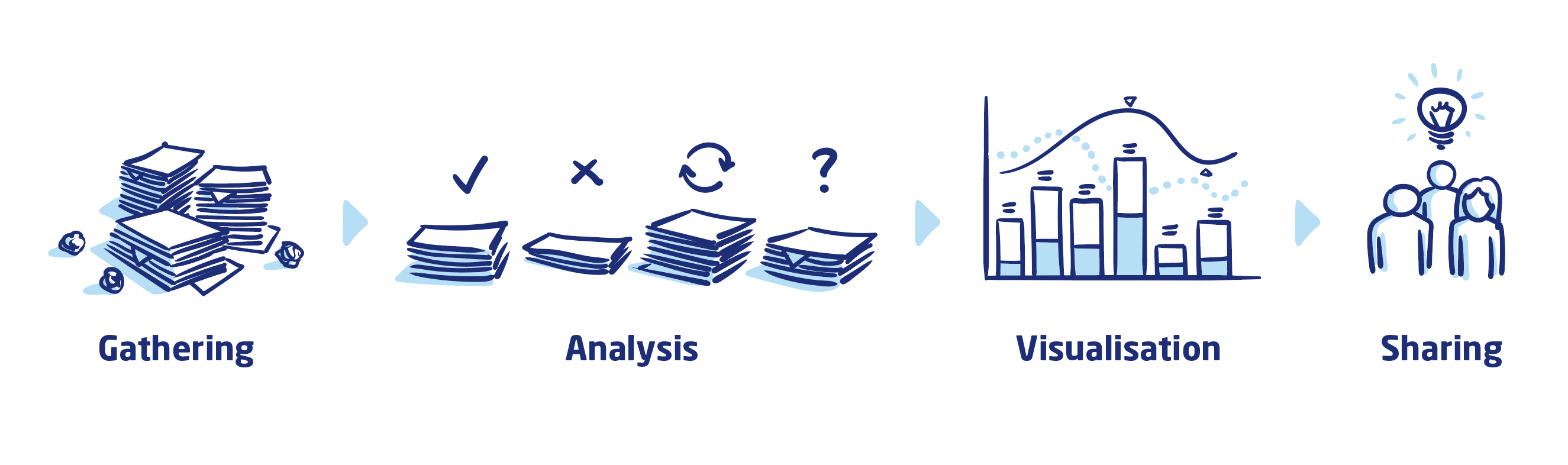

What needs to be emphasized, is that IDM is a complex process requiring regularity. Initially, it involves detailed Data Collection, where information from diverse sources – customer details, policy specifics, and claims data – is gathered. Subsequently, this data undergoes thorough Data Processing, where it is organized, cleaned, and transformed into valuable insights. The next step, Data Validation, ensures the accuracy and integrity of the information. As these processes unfold seamlessly, a well-integrated system emerges where previously fragmented data becomes a unified, streamlined resource.

The orchestrated flow of data optimizes operations, facilitates strategic decisions, and enhances both internal processes and customer experiences. In the dynamic landscape of the insurance sector, such an integrated approach becomes the linchpin for operational efficiency and agility.

Why Insurance Data Management is important?

In the world of financial services, the intersection of transactions and client trust necessitates a paradigm shift toward robust Insurance Data Management. It goes beyond being imperative – it’s the very bedrock of operational excellence.

Amid rising client expectations for personalized offers, evolving data storage regulations, and the transformative wave of AI and Cloud Technology, it becomes the foundation for meeting and exceeding these demands. Delve into the critical components outlined here, offering a strategic pathway for your insurance company not just to adapt but to thrive in an environment where data proficiency is synonymous with client satisfaction and industry leadership.

Benefits of utilizing Data Management in insurance

Unleash the full spectrum of benefits by embracing Data Management in your insurance operations.

Cultivating a comprehensive Customer 360 view equips policy managers with a nuanced understanding of individual preferences and needs, promoting personalized services and predictive insights for claims assessors.

Implementation of Master Data Management guarantees consistent and accurate data, offering policy handlers a reliable foundation for their work, ensuring secure practices, and supporting various business operations.

For those dealing with data protection, prioritizing Data Security and Privacy becomes paramount, instilling trust among clients and ensuring seamless compliance with privacy regulations.

Embracing data-driven business decisions transforms scenery of decision-making, empowering claims processors with insights that favour agility and a sustained competitive edge. In mastering Insurance Data Management, each process – from policy management to claims processing – is finely tuned for operational excellence, informed decisions, and heightened customer satisfaction.

Why Data Management needs a strategy?

Developing a robust strategy for Insurance Data Management necessitates a meticulous examination of diverse data types such as Big Data or Master Data, each with its unique characteristics. Big Data, with its massive volume and complexity, requires scalable infrastructure and advanced analytics to extract meaningful insights. On the other hand, Master Data, the core information shared across an organization, demands cautious governance to maintain accuracy and consistency.

Engaging key stakeholders is vital, as it ensures that the strategy aligns with industry’s best practices. Establishing clear policies for data quality and security is imperative, addressing the nuances of each data type.

When contemplating flexibility and scaling, attention should be directed towards creating adaptable systems that can accommodate evolving data needs without compromising efficiency. This approach guarantees that the Insurance Data Management strategy remains dynamic, effectively catering to the specific requirements of different data types and scaling seamlessly to meet the growing demands.

Leverage the Data Management Solutions

To craft a comprehensive strategy for effective Insurance Data Management, a systematic process is recommended, starting with Data Modernization as the foundational step for competitive adaptation. This involves assessing the current data infrastructure, identifying areas for improvement, and implementing modern technologies to enhance overall efficiency. Once the data is modernized, the next crucial step is Data Migration, ensuring a smooth transition from legacy systems to the updated infrastructure. This process involves transferring data securely, avoiding disruptions, and validating data integrity throughout the migration.

Subsequently, fostering collaboration through Data Integration is pivotal. This step involves consolidating data from various sources to create a unified view, promoting seamless communication and enhancing decision-making capabilities. Following integration, creating an agile environment with Data Fabric becomes essential. This involves designing a flexible and responsive data architecture that adapts to evolving business needs.

Simultaneously, ensuring scalable and accessible Data Storage is critical. This solution involves selecting appropriate storage solutions that accommodate growing volumes of data while maintaining accessibility and performance.

The next step is to employ Data Modelling for accurate analysis, where the structure and relationships within the data are defined, providing a foundation for effective analytical processes.

Establishing robust Data Governance is a continuous process embedded throughout the entire strategy. It involves defining policies, standards, and procedures to ensure the quality, security, and compliance of the data.

Finally, integrating Machine Learning for predictive analysis enhances the overall strategy by incorporating advanced analytics for predictive insights, further optimizing decision-making processes.

By following this systematic approach, Insurance Data Management solutions are implemented in a logical sequence, ensuring a cohesive and effective strategy for comprehensive data management.

Understand the architecture of Data Management Systems

Establishing an efficient and scalable architecture is pivotal for ensuring the effectiveness of data management systems. One key architectural concept is Data Mesh, which fosters a distributed and scalable data environment. This approach emphasizes decentralization, treating data as a product and promoting domain-oriented, self-serve data infrastructure. Data Mesh aims to enhance scalability and agility in managing diverse datasets across an organization.

Another essential architectural element is the concept of a Data Lakehouse, a hybrid approach that combines the strengths of data warehousing and data lakes. This architecture allows for the storage of raw, unstructured data, similar to a data lake, while providing the structure and organization characteristic of a data warehouse. The Data Lakehouse ensures versatility in handling different types of data while maintaining the analytical capabilities required for efficient data processing.

The role of a Data Warehouse is crucial within this architecture, serving as a centralized repository that enhances data accessibility and supports durable business intelligence initiatives. It is designed to facilitate reporting, analytics, and decision-making processes by providing a structured and organized environment for Data Storage.

Incorporating Data Streaming also plays a role in the architecture. This component enables the processing and analysis of data in real-time, unlocking dynamic insights for immediate decision-making. Data Streaming is particularly valuable in scenarios where timely information is vital, allowing organizations to respond swiftly to changing conditions.

To further gauge the effectiveness of the architecture, assessing the stages of Data Management Maturity is imperative. This involves evaluating the organization’s proficiency in managing data, from foundational stages to advanced levels.

Understanding these stages provides valuable insights for continuous improvement, guiding organizations toward higher levels of efficiency and effectiveness in their Data Management practices. Each component plays a unique role, and their relationships within the architecture are designed to enhance scalability, agility, accessibility, and real-time processing, contributing to a robust and effective data management system.

What are the challenges of Insurance Data Management?

Despite the benefits, challenges in insurance data management do exist. The main one that organisations face in this regard is lack of access to crucial information, because of Data Silos. This means that each department in the organisation stores data sets and systems independently, isolating others from accessing it. The answer for that is solid Data Governance, that requires obtaining the buy-in from the organisation. Navigate the continuous challenge of maintaining Data Quality, ensuring accuracy and reliability. Address the complexities of handling the overwhelming Overload of Data, managing vast volumes effectively. Prioritize Data Privacy Management, safeguarding sensitive information in compliance with binding regulations. Mitigate Security Risks, protecting data integrity against potential threats. Overcome resource constraints and skill gaps, building a competent data management team for sustained success. Overcoming these challenges is a must for successful Insurance Data Management.

From Our Perspective: Sollers is uniquely positioned to navigate the intricate landscape of this field. For those in the initial phases of their Data Management journey, Sollers is not just a provider of information; we are your strategic partner.

What sets Sollers apart is our holistic approach to Data Management. Beyond the realms covered in this guide, we extend our capabilities to encompass Insurance Data Analytics, Master Data Management, and the broader spectrum of Financial Services Data Management. By choosing Sollers, you opt for a collaborative partnership where we work hand in hand to enhance your Data Management practices, drive efficiency, and propel your organization towards unprecedented success in the realm of Insurance Data Management.

Mateusz Stasiak – Consultant at Sollers Consulting