In RIFE, insurance logic is centralized in one system which enables:

- easy and quick configuration of products, tariffs and processes tailored to the needs of bancassurance and insurance sales channels in banks

- all the handling processes required for insurance services in banks

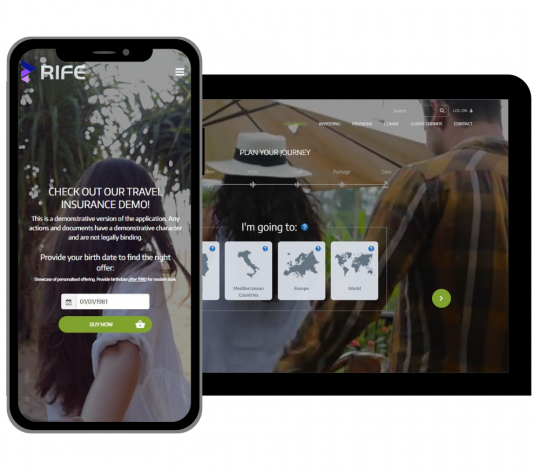

- modern and quickly configurable API allowing you to quickly start selling with any front-end