In times of rapidly changing technological environments and customer preferences companies face unprecedented challenges. New digital business opportunities arise, and competition takes on a new dimension. Boundaries between the industries and sectors are blurring. As business strategies and models are changing new solutions are needed.

These days, doing things the right way is not enough to gain and maintain a competitive advantage. Traditionalism guarantees neither success nor survival. A broader perspective and conscious strategy are needed. Let us get the big picture of social, technological and economic conditions, which influence reality and drive customer needs. To address and create these needs the companies are expected to follow market trends and drive them simultaneously. According to studies, strategic thinking comes here as a tool. It enables early recognising and analysing changes to the environment. The next obvious step would be an immediate reaction with an innovative solution.

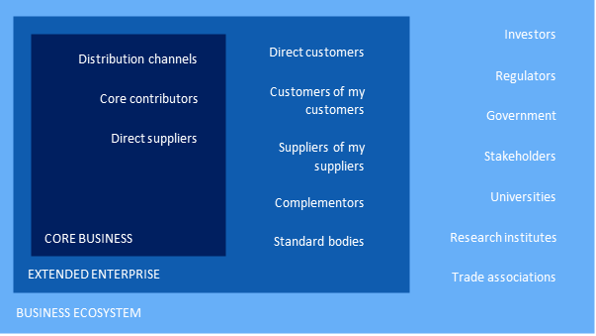

Currently, companies and industries face unprecedented market changes. Product life cycles and traditional value chains are getting shorter. This occurs because of decreasing entry barriers and the appearance of new players and start-ups. Similar disruptions occur in the supply chain. Namely, disintermediation, the removal of intermediaries as well as forward and backward integration can be observed. Coopetition evolves as a new dimension of competition and cooperation. Companies succeed by establishing and developing mutually beneficial long-term cooperation with members of different markets, sectors or environments. Companies build new structures combining sometimes competing suppliers, distributors, partners and other stakeholders. These structures are described and classified as business ecosystems.

Definition and etymology

A business ecosystem is a “network of different organisations involved in the delivery of a specific product or service through both competition and cooperation.” The concept assumes that each member of an ecosystem affects and is affected by others, which creates a constantly developing relationship. Each member has to be flexible and adaptable in order to be able to survive. The logic of the system is analogical to biological ecosystems. The parallel was first introduced in 1993 by a business strategist – James Moore. In his Harvard Business Review article: Predators and Prey: A New Ecology of Competition he compared “companies competing in the increasingly interconnected world of commerce to the community of organisms adapting end evolving to survive”. As mentioned before, the idea of a business ecosystem is not that new, the best-known business ecosystem evolution structure was proposed in 1996, also by James Moore and encompasses three stages (graphic):

- core business

- extended enterprise

- business ecosystem

On the basis of: The Death of Competition-Leadership and Strategy in the Age of Business Ecosystems (Moore, 1996)

Similarly, as in a natural ecosystem, organisations involved in a business ecosystem have to compete for survival, adapt or go extinct. Moreover, organisations are often participants of not only one industry but of many different interlinked markets, sectors, or industries. The idea of cooperation is to co-evolve capabilities and roles, set a common goal and align the activities to one mutual direction, set by the leading companies, which can change over time. The most important issue for all members is to share a vison and values, as it ensures benefits for all participating parties and thus provides sustainability.

Characteristics

A characteristic element of a business ecosystem structure are high entry barriers. Every ecosystem is naturally surrounded with some kind of a moat, which protects it from the external environment and unwanted entrants. This mechanism protects ecosystem’s internal knowledge, technology, know-how, patents, research resources and specific cooperation conditions. Unique compilation of these factors can leverage the potential of a single factor, create a synergy effect, and ensure a competitive advantage. While duplicating a single product might be easy, duplicating the whole ecosystem seems to be challenging or even impossible. Moreover, if the increasing number of organisations improves the value of products or/and services, a network effect can be observed. On the other hand, building an ecosystem diversifies the total risk of a business activity. A heterogeneous group is surely less sensitive to external distractions and stays stable, even in the demanding external conditions.

Crossing the borders and looking for the user loyalty

By crossing the borders of a single industry, ecosystems are creating totally new markets, which encompass products and services from diverse and sometimes very distanced sectors. However, the main idea for such a wide cooperation is to provide customers with a holistic and unique user experience. This applies for the insurance sector as well.

Due to the dynamic digital business development, customers’ expectations have changed significantly. It is not so much about satisfying a need but about convenience, and companies must respond to that. There is an immense choice of comparable products. Competition is growing, customer loyalty suddenly disappears when a better offer enters the game.

This raises an obvious question: How to maintain and expand the customer base of a company in such market conditions? According to the research, innovation and management provide the answer. To win customers’ attention, interest and loyalty, companies must provide unique or even revolutionary solutions and an exceptional user experience. If this approach is accompanied by several complementary goods and services, it creates a widely desired lock-in effect.

Based on data collection, advanced analytics, behavioural economics and valuable insights, companies who belong to an ecosystem are able to tailor their offer, so that it suits customers’ expectations perfectly. Moreover, they create new customers’ needs. From the insurers’ perspective data can be a future key success factor. It enables effective profiling, risk estimation and customer segmentation. Even though customers usually are cautious about sharing their personal data directly, inside of an ecosystem it might happen indirectly. The new sources of data, its appropriate usage and, of course, its protection, are key challenges and opportunities for the new era of insurance. It is not only about going digital, it is about innovating and managing change, innovations, and trends. Customers do not expect offline products made available online, they demand new insurance products for cyber risk, commuting, travelling, pets, health protection, etc. Other, not mentioned benefits generated by ecosystems, encompass lowering distribution costs or improving claims prevention.

Current state and possible future development

These are the key benefits of building, maintaining, and developing a business ecosystem:

· Developing new ways of cooperation in order to minimise the external risk and be able to face new social, economic, and technological challenges

· Improving knowledge transfer and creativity

· Increasing the number of innovations and reducing time to market

· Lowering production costs (economies of scale and scope)

· Fulfilling complex customer’s needs in the best possible way, ensuring unique customer journey and experience through extensive data collection and analysis, creating tailored loyalty programs

Digital ecosystems customise products, improve customer experience and extend the boundaries of creating value in insurance. It is up to the insurers, whether they will use this opportunity or not. Depending on whether they want to form or join an ecosystem. Customers are open, markets are changing, it’s the right time to be active and creative.

References:

Moore, J.F. (1999), Predators and Prey: A New Ecology of Competition, https://www.researchgate.net/publication/13172133_Predators_and_Prey_A_New_Ecology_of_Competition, Harvard Business Review 71(3)

Moore, J.F. (1996), The Death of Competition: Leadership and Strategy in The Age of Business Ecosystems, Harper Business

Avramakis, E., Anchen, J., Raverkar, A. K. & Fitzgerald, C. (20019), Digital ecosystems: extending the boundaries of value creation in insurance, https://www.swissre.com/institute/research/topics-and-risk-dialogues/digital-and-technology/Digital-ecosystems.html

Lorenz, J. T., Deetjen, U., van Ouwerkerk, J. (2020), Ecosystems in insurance: The next frontier for enhancing productivity, https://www.mckinsey.com/industries/financial-services/our-insights/insurance-blog/ecosystems-in-insurance-the-next-frontier-for-enhancing-productivity

Hayes, A. (2019), Business Ecosystem, https://www.investopedia.com/terms/b/ business-ecosystem.asp

Heikkilä, M., Leni Kuivaniemi, L. (2012), Ecosystem Under Construction: An Action Research Study on Entrepreneurship in a Business, Technology Innovation Management Review, https://www.researchgate.net/publication/326312926_ Ecosystem_Under_Construction_An_Action_Research_Study_on_Entrepreneurship_in_a_Business_Ecosystem

Hagel, J., Brown, J. S., Wooll, M., de Maar, A. (2015), Shorten the value chain. Transforming the stages of value delivery, Deloitte University Press, https://www2.deloitte.com/content/dam/insights/us/articles/disruptive-strategy-value-chain-models/DUP_3057_Shorten-the-value-chain_v2.pdf