The impact of Open Insurance on data infrastructure

In early July 2023, several EU bodies released details of the EU Data Act and FIDA. Both have a positive impact on the insurance industry, as companies are able to access their competitors’ customer data as well as IoT data. This is a new starting point for data-driven insurance models. Companies will update their data management strategies and modernise their data infrastructure.

The new Open Insurance legislation requires insurers to create data structures that allow insurance data to be shared with third-party providers. There are still many details to be worked out in this regulation, which will affect non-life insurers across the European Union. The Financial Data Access Framework (FIDA) is part of the Open Finance Regulation, which extends PSD2’s regulation of bank interfaces to the entire financial sector. It was published alongside the EU Data Act, which will open Internet of Things data sources to other companies. Both represent an opportunity and a challenge for insurers.

Increased focus on insurance APIs

One of the key benefits EIOPA has identified is an insurance data dashboard that provides a digital overview of all the insurance policies a customer owns. Insurtechs offering this service are struggling with immature insurance APIs. However, Open Insurance regulations will bring other benefits to insurance companies. Let me name a few of them:

- Customer 360-degree view

- Embedded insurance

- Automation

- Efficiency and effectiveness

- Improved service

- Faster response times

- Better availability of data

There are still many things to sort out before Open Insurance becomes a reality. It will be necessary to define what data will be shared and how the data will be shared, both from a business and technical perspective. It will be necessary to agree on who and how API standards should be developed. EIOPA recognizes that there are several national standards initiatives such as Bipro in Germany or EDI Courtage in France, but these are still isolated solutions that do not cover the entire market.

It would make sense to base the new Open Insurance Standards on the existing national standards, EIOPA stresses. However, this would jeopardize the creation of a single European insurance standard. The timeline for the creation of these new open insurance APIs is very ambitious, and both the technical standard setters and the industry need to accelerate their preparations. We see that initial action is already being taken in various markets, so Open Insurance will act as a wake-up call for the industry.

Many European insurers struggle with data infrastructure

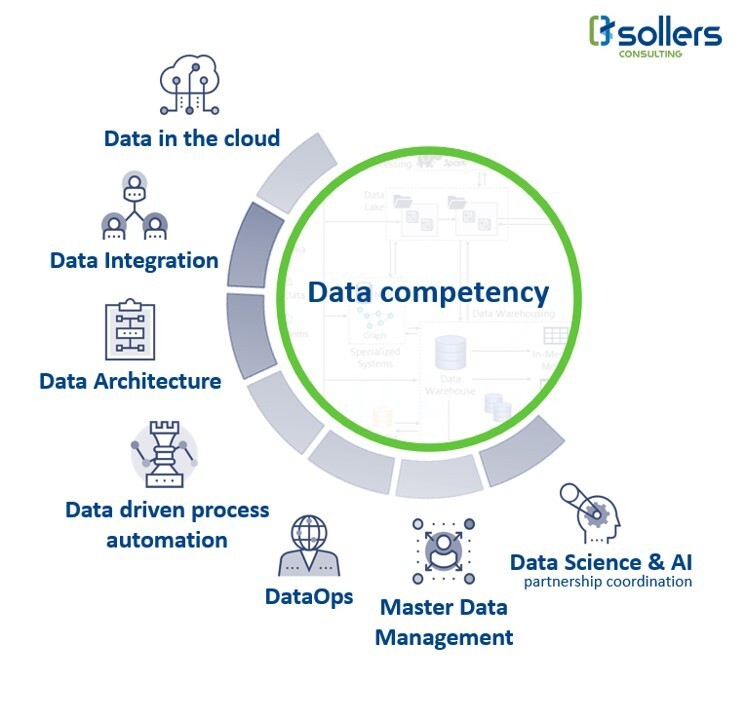

This new focus on APIs will drive insurance companies to revise and align their data management strategies. According to our estimates, only 20% of insurance companies in the European Union have a mature data infrastructure. “Some insurers have started to centralise their data and create data lakes,” writes Slawek Gdyk. “But many companies still struggle with their own data because it is spread across many systems, inaccessible and unusable.”

Currently, data infrastructures are often changed as part of system implementations (core systems, claims systems) or as part of automation projects. However, early indications are that insurance companies will develop a new approach to data management. One of the main benefits of this effort will be a groundbreaking improvement in insurance data quality. Insurance companies will have to decide whether to rely on traditional data warehouses or establish data lakes that allow them to process large volumes of unstructured data. This will be critical to any customer service automation efforts, as companies will need to build image recognition (for claims) and voice recognition capabilities. AI tools can enable automation of high-volume tasks in these areas, but systems and data infrastructures must be ready.

Data streaming supports personalization

A hybrid solution in the form of a data lake house may also be an option. In building these new data infrastructures, the cloud will become enormously important. It is therefore very positive that the EU has strengthened legal support for the cloud through various regulations in the EU Data Act. As IoT-based business models become more prevalent, we expect insurers to pay more attention to data streaming. Streaming technology can help insurers improve their customer journeys through deep personalisation. A classic use case where streaming adds value is real-time analytics and fraud detection, where reporting time is of great importance.

As Open Insurance and the EU Data Act become a reality, insurers will need to improve their data management and leave immature legacy structures behind. A coherent data infrastructure will help improve the customer experience and increase automation in almost all business processes, from risk assessment to pricing, payments, product offerings, fraud detection, and claims processing. The enormous potential of data analytics, machine learning and artificial intelligence is still largely untapped.

Mateusz Stasiak – Consultant at Sollers Consulting