Warsaw/Cologne/Tokyo/Paris/Richmond, June 30, 2022: The insurance industry has entered a crucial phase of IT modernization. Surveys of insurance industry executives by Sollers Consulting show that cloud will play a crucial role in this process. Dominik Kamiński, Head of Cloud at Sollers, predicts what will happen in the current decade.

1. Cloud will become a new standard in the industry

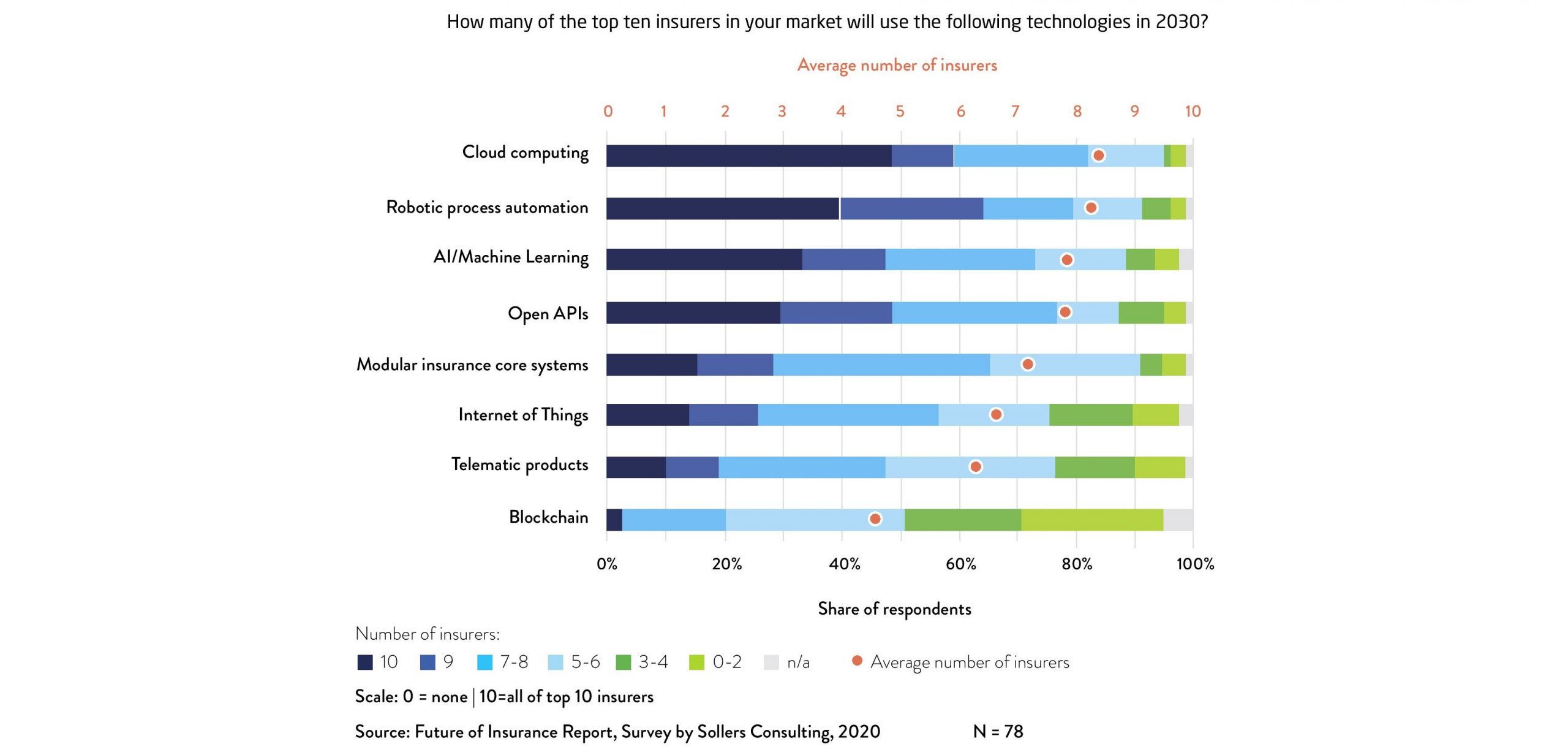

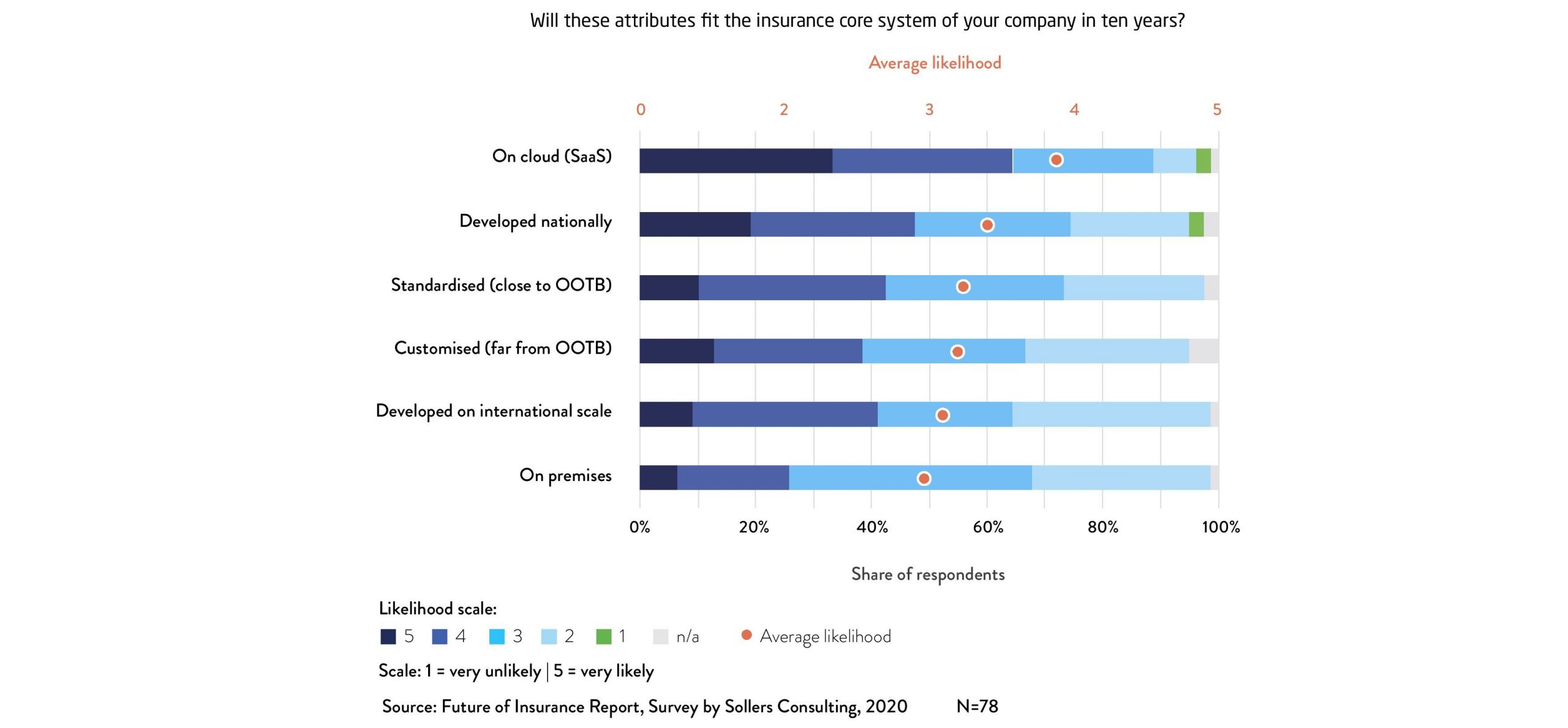

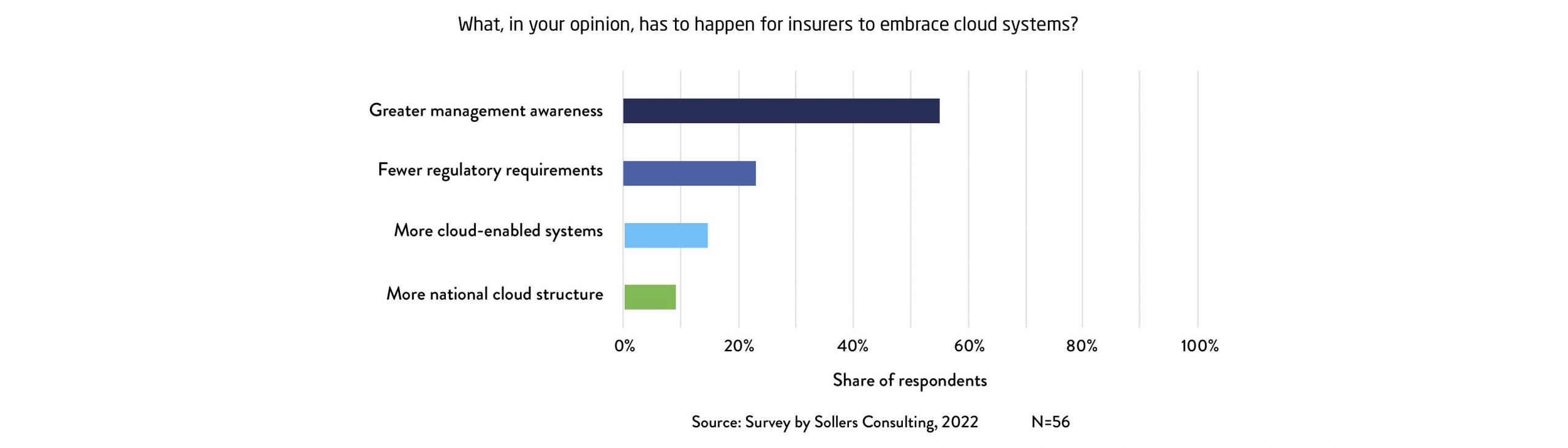

Cloud is a technology that insurers are initially reluctant to embrace. But CIOs and technology-focused specialists are pushing cloud-based solutions. Eight of the top 10 insurers in each market will rely on cloud by 2030, a Sollers survey from 2021 shows. The same year CIOs and IT professionals said cloud-related costs and compliance issues were the top constraints. In a recent Sollers survey, IT professionals in the insurance industry said greater management awareness is needed. As confidence in cloud increases, cloud adoption will become more prevalent in the insurance industry. Insurers are accelerating their IT modernization, and cloud will become a standard tool in the insurance industry, as it already is in many other industries. The shift to cloud has begun and will become widespread by 2030.

2. Competition among cloud providers will increase

Despite numerous initiatives and new companies in many countries, the dominance of the largest cloud providers will not disappear. However, this dominance is not a constraint on innovation. Competition among existing cloud providers will increase and shift to services, and they will offer more and better solutions for the use of artificial intelligence, data analytics and security. Until recently, two providers, AWS and Microsoft Azure, dominated the cloud offering. But Google has jumped on the bandwagon, offering new additional services, such as cyber insurance from Munich Re and Allianz, as well as highly skilled artificial intelligence solutions. Local players are investing to respond to the growing demand. In France, for example, OVH Cloud is following suit, while in Germany it is Deutsche Telekom, Ionos and Stackit. However, local providers will not be able to match the technological level and security of the big three. The leading cloud companies offer a very high level of security and compliance certifications and are better able to support customers with regulation than local providers. AWS, Azure and Google Cloud will continue to dominate and will be accepted as “advanced” cloud providers, while local providers will limit themselves to “simple” cloud solutions.

3. Multi-cloud will be the preferred option

As the market for cloud services matures, multi-cloud will become a preferred option for many insurers. In a multi-cloud approach, an insurer uses services from two or more providers in parallel. With a multi-cloud strategy, insurers can benefit from the strengths of specific cloud environments. Multi-cloud is becoming the preferred option for two reasons: the first is compliance with regulations that require companies to have an exit strategy. Insurers and other financial institutions need to be able to move their IT from one cloud provider to another or to their own data center as needed. The second important point is the increased agility that comes with a multi-cloud strategy. Insurers will look to be able to switch to other cloud providers if an existing provider changes its pricing policy or the scope of services no longer meets the insurer’s needs over time. Accordingly, technical tools that facilitate multi-cloud will become more prevalent.

4. Vendor-lock in the cloud will decrease

As the use of cloud increases, insurers will avoid solutions that create vendor lock. There are more and more solutions and technologies that help avoid cloud vendor-lock. Enterprises will rethink their migration to the cloud. New Infrastructure-as-a-Code (IaC) solutions and cloud-agnostic services available in the cloud offer a wide range of opportunities to build efficient solutions in the cloud that are more portable and do not create vendor lock.

5. Cloud regulation will turn to practicality

As part of its Open Data strategy, European insurance regulator Eiopa has launched the Open Insurance initiative to create common APIs (Application Programming Interface) for the insurance sector. This will accelerate the digitization of the sector, which has been blocked for decades by individualized approaches. Cloud regulation will push the insurance sector to advance its digitalization efforts by moving from prevention to practice. In Germany, the government has decided to strengthen the use of cloud, and in the UK, cloud is seen as part of digital innovation and a key target for market attractiveness.

The financial industry regulator in France started exploring the benefits of cloud in 2013. Today, leading players in the insurance sector such as MACIF, Covéa, BNP Paribas, MAIF, Generali or the aggregator Les Furets are using the cloud, moving to the cloud or modernizing their approach. The new French government is expected to heed the industry’s call for clearer rules on cloud usage. In Poland, the Chmura Krajowa initiative is already creating a national framework for the implementation of a multi-cloud strategy combining the services of Microsoft Azure, Google Cloud and an evolving cloud infrastructure of its own. It was launched to enable companies from industries with specific regulations to fully utilize cloud in accordance with the Polish law. Chmura Krajowa is a pioneer for insurers and other companies in the financial sector in implementing a sound cloud strategy.

6. Business automation through AI will be an important goal when moving to the cloud

The use of artificial intelligence (AI) is now a reality, making many services faster and better. According to an IBM survey, one in three companies already uses artificial intelligence. AI is used in photography, optical character recognition, sound engineering, speech tools, voice recognition, marketing and many other areas. There are also many use cases for AI in the insurance industry, as it can speed up and, in some cases, automate underwriting, prevention and claims processing. In practice, however, insurers are reluctant to adopt available AI solutions due to outdated IT infrastructures. In surveys by Sollers Consulting, cloud was cited alongside robotic process automation and artificial intelligence as the most important technology for insurers by 2030. The use of cloud is a prerequisite for AI deployment in most cases. Cloud providers offer the most advanced and mature AI solutions and are constantly developing them. Developing own tools in this area would be a huge investment with high risk. We will therefore see a widespread movement towards the cloud with the aim of implementing AI-based solutions.

7. Increasing cyber threats will support the trend toward the cloud

Threats from cyberspace have become a major issue in the insurance industry. Insurers are covering an increasing number of cyber events. At the same time, their infrastructure is highly exposed to cyberattacks. Cloud adoption will be part of the solution. In theory, cloud is vulnerable to cyber threats. But it offers de facto better security at a lower price. Cloud providers can take full advantage of economies of scale and invest much more in cybersecurity than individual companies can in an on-premises environment. Insurers will make full use of encryption and other data protection tools which are constantly developer by cloud providers. Cloud will make a significant contribution to increasing cybersecurity in the industry.

Glossary

API: An application programming interface (API) is a connection between computers or computer programs. It is a software interface, offering a service to other pieces of software.

Hybrid Cloud: Hybrid cloud is a composition of a public cloud and a private environment, such as a private cloud or on-premises resources, that remain distinct entities but are bound together.

IaaS: Infrastructure as a service (IaaS) is a cloud computing model by means of which computing resources are hosted in a public, private, or hybrid cloud.

IaC: Infrastructure as Code (IaC) uses a high-level descriptive coding language to automate provisioning of IT infrastructures. It eliminates the need to manually provision and manage servers, operating systems, database connections, storage, and other infrastructure elements.

Multicloud: Multicloud is a company’s use of multiple cloud computing and storage services from different vendors in a single heterogeneous architecture.

PaaS: Platform as a service (PaaS) is a category of cloud computing services that allows customers to run and manage a modular bundle comprising a computing platform and one or more applications.

Private cloud: Private cloud is cloud infrastructure operated for a single organization. Infrastructure is not shared with non-related external organizations.

Public cloud: Cloud services are considered public when the infrastructure needed to provide the services is shared with many independent tenants.

SaaS: Software as a service (SaaS) is a software licensing and delivery model in which software is licensed on a subscription basis and is centrally hosted.

RPA: Robotic process automation (RPA) is a form of business process automation technology based on software robots or on artificial intelligence.