Customers expect faster claims processing from insurers

Surveys by Sollers Consulting and Ipsos show that customers expect their insurers to process claims quickly when they make a claim. Insurance companies are struggling to respond to customer demands. Sollers and Appian expect the industry to intensify claims automation efforts.

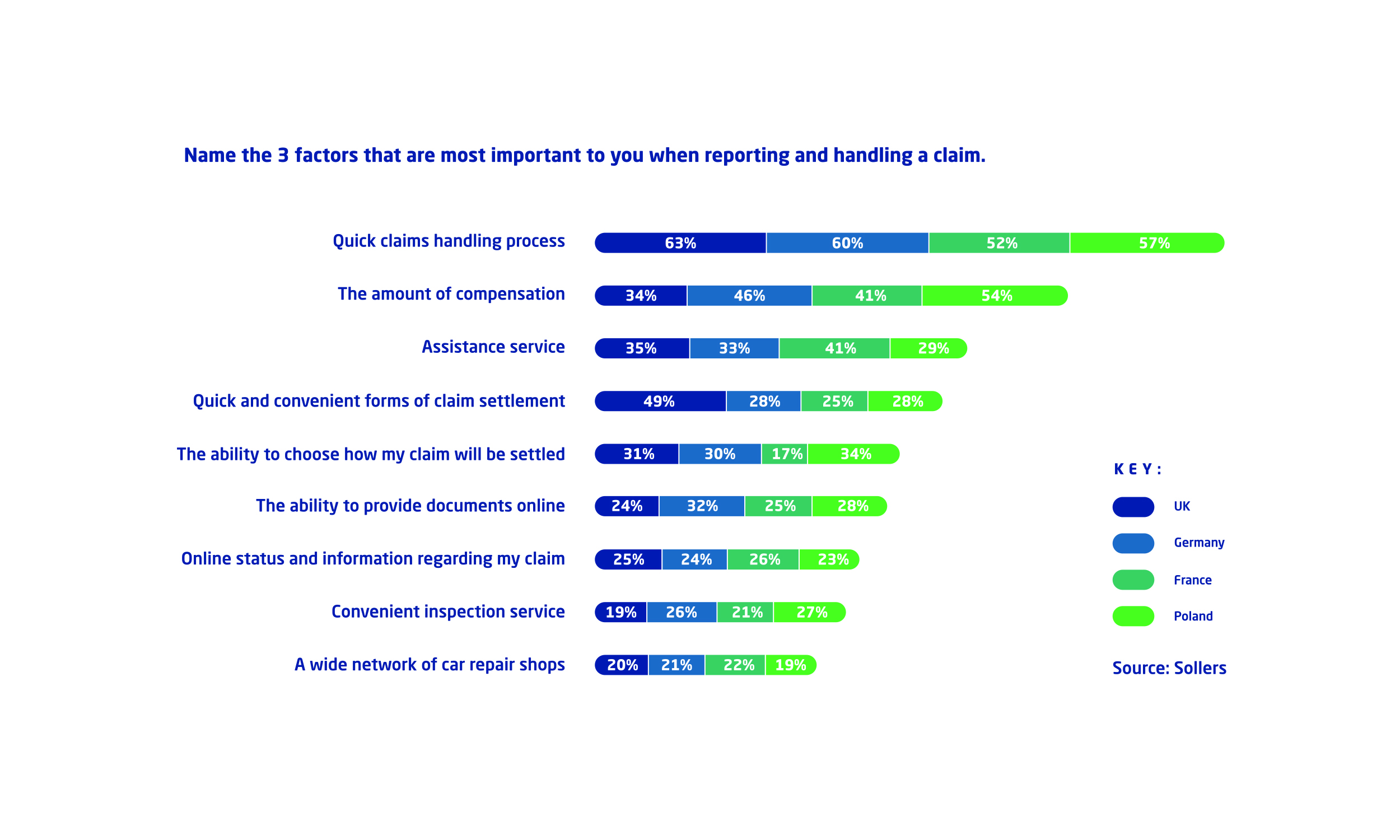

Fast claims settlement is the most important thing for insurance customers when it comes to claims handling. In surveys conducted by Sollers Consulting in collaboration with Ipsos in four countries, 52% to 63% of customers stated that a quick response is one of the top three expectations they have after making a claim. The demand for fast claims handling is strongest in the UK, followed by Germany (60%), Poland (53%) and France (52%). In the UK, Germany and France, fast claims handling is the most important factor for customer satisfaction, more important than the actual amount of compensation paid by the insurer, as the Sollers survey shows. In Poland, the amount of compensation (54%) is almost as important to customers as the speed of claims handling (57%).

However, the industry’s experience in the UK, Germany and several other countries shows that there are serious shortcomings. Particularly after major NatCat events, insurers have received negative feedback from customers, consumer organisations and regulators about their claims handling capabilities. When it comes to processing claims, human contact is more important for customers than when buying and using other services from an insurance company. 50% of UK customers prefer to submit a claim via a call centre, 36% of insurance customers in France want to submit a claim via an agent and 37% via a call centre, finds the Sollers survey.

“It is highly beneficial for insurance companies to invest in technology to speed up claims processing,” comments Lennart Imorde, Head of Process Automation at Sollers.

” Our survey shows that the most important thing for customers is not the money, but the solution to the problem,” says Aleksander Czarnołęski, Senior Consultant at Sollers. “To improve customer experience, streamlining claims handling is crucial. We are seeing more and more insurers investing in claims technology as they recognize that it also helps to reduce claims handling costs.”

In many countries, insurance companies have started to invest in the automation of claims processing to increase customer satisfaction and become more efficient. In the UK and Poland, artificial intelligence is becoming a common technology in claims management. In Germany, there is a trend towards digital claims management. French insurers are modernising their connectivity to improve and speed up claims handling by brokers, agents and call centres.

“The insurance landscape continues to evolve rapidly. It remains imperative for insurers to embrace automation, cut operational expenses, and elevate customer experiences to remain competitive and viable as a business,” says Gijsbert Cox, Insurance Industry Leader at Appian. “Insurance process automation solutions with artificial intelligence and connected data have proven transformative for industry frontrunners to accelerate claims handling, underwriting, and processing time. We anticipate widespread adoption among insurers seeking to optimize operations and exceed customer expectations in this fast-paced environment.”

Automated solutions help to tackle time-consuming manual tasks and enable claims handlers to better meet the needs of customers. Appian and Sollers are working together to enable insurance companies to better support this.